Saturday, November 15, 2008

Obama on Redistribution of Wealth

Wednesday, October 22, 2008

The Road Not Taken

So, for those of you who are committed to an Obama presidency, I would ask you to consider three decision criteria in selecting our next president: character, experience, and accomplishment. In the business world, these three criteria are generally evaluated through a review of a written resume, validated through a personal interview, and a final hiring decision confirmed through personal references. With respect to a personal resume, you have Obama's own books (Dreams from My Father and Audacity of Hope) and books written about him (The Obama Nation by Jerome Corsi and The Case Against Barack Obama by David Freddoso). With respect to interviews, you have Rick Warren's Saddleback debate, the Presidential Debates, and interviews with numerous cable pundits. However, one is hard pressed to confirm the hiring decision through personal references, as this is not an area the media wants to fully explore. So, I decided to find the most comprehensive list I could so that you could make an informed decision. They are summarized and illustrated through video documentary in the Cloward Piven Strategy - Part 2 - Political Allies and Advisors. As my father told me "You will be judged by the company you keep." I guess this does not apply to Barack Obama.

As for me, I think I will stay on The Road Not Taken (Robert Frost, 1920).

"I shall be telling this with a sigh

Somewhere ages and ages hence:

Two roads diverged in a wood, and I—

I took the one less traveled by,

And that has made all the difference."

Friday, October 17, 2008

Second Open Letter to the United States Congress

"The purpose of this letter is to request information about the contractual nature that the US Treasury has with the various financial institutions, which Congress has authorized the Treasury to nationalize. Specifically, is the Treasury receiving voting shares for its investment? If so, how and by whom will these shares be voted? If shares are being issued, I would like to receive mine in the mail. Otherwise, I am concerned that when these shares appreciate, as they must according to Mr. Paulson (as he knows that the mark to market rule allowed him to buy these shares at a depressed value), then I want to make sure that my pro rata share of the proceeds are returned to me. Otherwise, I fear they will be absorbed by the US Government and returned to organizations such as ACORN, Fannie Mae, Freddie Mac, and other entities who do not have my best interest in mind.

While I await word from you, I will spend my time in retirement working to recover one-third of my life savings. Plan B is to figure out how to die 33% sooner than my actuarial age, which will be bad for me, but even worse for those who were depending on my continued contribution to their prosperity and ultimate realization of the 'American Dream.' ”

Sunday, October 12, 2008

Money Ain’t For Nothing … and the Checks are for Free!

America is at a “strategic inflection point” in its history. I believe that if Obama is elected, our children and grandchildren will look back in history and identify this election as the point in time we transitioned from a free, capitalist society – one nation under God with equality of opportunity for everyone – to a Marxist socialist one – a multi-cultural, secular humanistic post-modern society that seeks equality of outcome for everyone but its “intellectual elite,” who view themselves as saviors of the common man and worthy of special dispensation. The Bush Administration’s policies are not the cause of the recent economic implosion, as much as the left would like to us to believe. The cause is the result of a relentless, long-term strategy that was implemented by Marxists starting in the 1920s, brought to the United States in the 1930s, and fully implemented starting in the 1950s (see Taking America to School … and Other Places We No Longer Recognize for background, discussion, and links to Obama’s world view).

The principal thesis of this movement (Critical Theory) was that Marxism could not defeat Capitalism through direct conflict or economic means but had to first undermine its culture by attacking its underlying institutions: the nuclear family, its Christian faith, education, media, entertainment, and popular culture. As the theory goes, success in subversion of these institutions would lead to economic, political, and military collapse. This is exactly what we have seen. Future articles will examine trends in each of these areas; however, suffice it to say that the current economic meltdown is simply a result of this much larger strategy. Our current economic woes are the result of 70 years of social engineering, which has year-by-year – in 2007 inflation adjusted dollars – driven federal spending in 1965 from $628 billion to $2.7 trillion in 2007 (a 334% increase), while the median income of the average American has risen 35% ($28,346 to $38,386 per year). Over this period, mandatory spending on entitlement programs (social security, Medicare, Medicaid, Welfare, etc.) has grown from 26.9% of the budget to 52.9% of the budget. These programs had their genesis in the 1930s through democrat president Franklin D Roosevelt’s “New Deal” and came into full bloom under democrat president Lyndon Johnson’s “Great Society.” When interest is considered (8.3%), only 38.8% of the budget is discretionary (within the control of the President).

One of these social engineering programs was the Community Reinvestment Act (CRA), signed into law by democrat president Jimmy Carter in 1977 and further expanded by democrat president Bill Clinton in 1999 to offer sub-prime mortgages to low and moderate income persons, who otherwise could not afford them. This fiscally irresponsible, social engineering program targeted at providing “affordable housing” to those who could not “afford” it directly resulted in the economy crumbling under the weight of credit that could not be repaid. In true socialist fashion, the democratically controlled congress – aided and abetted by a minority of clueless Republicans – have now exacerbated the problem by throwing more fuel on the fire, in the form of $700B in cash guarantees. Instead, they should have taken action by unleashing the power of free market capitalism: eliminating insane mark to market rules, reducing capital gains taxes, reducing corporate income taxes, and debating the merits of new tax systems like the fair tax or flat tax system. Note: all solutions proposed by democrats require the government to be in the middle, and that is the problem.

So, what is the bottom line (pun intended)? The progress made by the Bush administration over the past six years has been erased in two weeks by long-term, systemic socialist policies that have been at work for 70 years. A little over a year ago, consumer confidence stood at a two-and-one-half year high, regular gas sold for $2.19 per gallon, the unemployment rate was 4.5%, the Dow reached record highs, and Americans were buying new cars. Over the six year period, the Bush administration has put forward proposals to regulate Fannie Mae and Freddie Mac, address social security, address energy policy, and address health care. Many of these proposals passed the House, only to die in committee in the Senate because they were blocked by the democrats. Since the democrats have taken control of congress, every one of these economic indicators has reversed and to borrow a phrase from one of their social justice theorists, Rev. Jeremiah Wright, “the chickens have come home to roost.” Consumer confidence has dropped, the Dow is trading in ranges we have not seen since the 1970s, a record number of homes are in foreclosure, unemployment has risen by 10% (to 5.5%) , and the federal deficit has ballooned.

May be the market understands, better than the voters, the true cost of Obama’s Change: you give him a dollar and he gives you back two cents.

Wednesday, October 8, 2008

Comments on the 2008 Second Presidential Debate

Rick Warren's Saddleback debate was the most informative of all the candidate debates. If the first two presidential debates had followed the Saddleback format and / or asked similarly insightful questions on key issues like the economy, energy, the war, education, and healthcare, perhaps the American people could determine the difference between each candidate’s position. To me the choice is straightforward. We can either vote for the McCain / Palin team, which supports a Judeo Christian worldview, demonstrates high personal moral character and integrity, and has a proven track record or we can vote for Obama, who has a Marxist / humanist world view, a questionable moral character, and no proven track record. I purposely left Biden out because his views are immaterial: he has demonstrated consistently that he cannot even get his facts straight. As the mortgage guy on the radio says, "This must be the biggest no brainer in the history of the earth." Any further discussion is little more than rearranging the deck chairs on the Titanic ...

... at least they had a band.

Thursday, October 2, 2008

Obamanomics 101 – The Root Cause of Our Current Economic Crisis

Attached is an article published in the Urban Affairs Quarterly, March 1979, discussing the topic of “Financing Home Ownership, The Federal Role in Neighborhood Decline.” It traces the history of home financing from 1934 to 1979. Its conclusion, ironically, is that even at the time of its writing in 1979 that “federal policies and programs designed to expand the opportunities for home ownership have often contributed to neighborhood decline rather than curing it.” It also describes the credit market that was created for “community organizers” by federal policies. In essence, these federal policies view communities as “sophisticated conglomerates, whose major subsidiaries, the housing market, the business sector, and the social institutions, are themselves composed of smaller economic units, such as households, individual organizations, and enterprises – all of which are integrated through interdependent financial interactions, each depending upon a supply of credit to expand its own capital and make new investment in order to survive.”

In contrast to a capitalist view of the market where monetary investment is made by individuals and by corporations in ideas and capital equipment and the consumer determines winners and losers, the community organizer model relies on the federal government passing socially progressive legislation that makes monetary investment in the “conglomerates,” described above, through quasi-governmental agencies like Freddie Mac and Fannie Mae. Freddie and Fannie provide tax-payer money and access to easy credit to persons who otherwise could not afford it. Enter the “community organizer,” who trains the so-called “disenfranchised” to believe that they are victims of a corrupt capitalist society, that they are entitled to the “American Dream,” and then indoctrinates them in a liberal, socialistic ideology. For the organizer, the medium of exchange for the “American Dream” no longer becomes money, but instead a vote. The “organizer” organizes the communities to believe that they are “companies,” in which society has a moral mandate to “invest.” The “organizer” then forms organizations like the Association of Community Organizers for Reform Now (ACORN) – funded at taxpayer expense – to encourage low income, poorly educated, disenfranchised persons, whose principal asset is that they are over 18 years old but otherwise are clueless, to vote for socially progressive legislators, who will further expand these socially progressive programs. In essence, the “social progressive” seeks to replace equality of opportunity, with equality of outcome. Obama’s euphemism for this model is “being neighborly.” My definition is Marxist socialism.

So the real question is this. If we are about to elect “The Organizer in Chief” to be the next President of the United States of America, does his “trickle up” economic model work? I guess some would point to Europe as a success story; I would think most Americans would disagree. So instead of debating that issue, a better question to ask is “how has the ‘organizer’ model benefitted the community represented by Barack Obama – Chicago?” Chicago is a good example, because of Obama’s long history of service in the community, as a community organizer, state congressman, state senator, and US senator. The elected representatives from this area are all democrats – no republicans to blame! So here goes:

1. In the last six months, more people have been murdered in Chicago (292) than killed in combat in Iraq (221).

2. The state pension fund is $44B in debt – the worst in the country.

3. The Chicago school system is one of the worst in the country.

4. Cook County Illinois (Chicago) sales tax is the highest in the country – 10.25%.

I know, I know – we have not invested enough, the folks have been victimized, and they are entitled to better. I submit we have invested more than we can afford in this 30 year social engineering project. It has resulted in the need to enact a $700B bailout of the credit system that will have to be borne by all of us, our children, and their grandchildren. This “investment” in the alternative economic world of social progressive politics has bankrupted all of us. For someone whose self described strong suit is “economics,” Obama would be well advised to read the modern version of the “Goose that Laid the Golden Egg” by Richard Cummings.

Monday, September 29, 2008

An Open Letter to the Virginia Members of the United States Congress

Taking money out of the hands of “hard working” Americans and putting them in the hands of politicians has resulted in a 334% increase in Federal spending since 1965 (from $628 billion to $2.7 trillion in 2007 inflation adjusted dollars), while the median income of the average American has risen 35% ($28,346 to $38,386). Over this period, mandatory spending on entitlement programs has grown from 26.9% of the budget to 52.9% of the budget. When interest is considered (8.3%), only 38.8% of the budget is discretionary (within the control of the President). A better solution is to take the decision making out of the hands of a do-nothing, socially progressive government and let the average “hard working” American decide for himself or herself how to spend his or her income.

In my mind the decision is simple. Do we want a country in which individuals create and distribute wealth (equality of opportunity -- capitalism) or one in which the government taxes the successful and puts it in the hands of a few (the Government) who then redistributes it as it sees fit (equality of outcome – socialism)? We are rapidly moving from an economy where the medium of exchange is one of money to one of votes (47.3% of wage earners do not pay federal income tax, but receive benefits and tax credits). We would be well served to remember the advice of Thomas Jefferson: ““Every government degenerates when trusted to the rulers of the people alone. The people themselves, therefore, are its only safe depositories.” – Thomas Jefferson, Notes on the State of Virginia, Query 14, 1781.”

Saturday, September 27, 2008

What Happened to Our Economy?

Wednesday, September 10, 2008

Taking America To School … And to Other Places We No Longer Recognize

My first indication there was a real problem was on September 7, 2008, when Eric Shawn of Fox New’s Weekend Live asked Bob Beckell why Obama had not released his college transcripts and his college thesis, a requirement for graduation. Apparently, Obama’s wife had already released hers. Beckell’s response was that the average American didn’t wake up in the morning asking about Obama’s college transcripts. Alarm bells went off. So, I did some immediate investigation and learned that Obama was a Political Science major at Columbia University. The alarm bell got louder. I remembered reading in Pat Buchanan’s book Death of the West (DOW) that Columbia University was the home to the transplanted Frankfurt School, a school of German Marxist thinkers, and to Herbert Marcuse who championed this cultural revolution school of thought in America in the 1960s. With a little additional research I found that Marcuse’s son, Peter Marcuse, retired as a professor at Columbia and is the “keeper” of the official Marcuse home page (www.Marcuse.org). Disciples of this ideology include Frank Marshall Davis, Malcom X, and Saul Alinsky, all of whom were identified by Barack Obama in his books (Dreams from My Fathers and The Audacity of Hope) as either mentors or influential thinkers in the formation of his world view. In fact, Alinsky was the founder of the Industrial Areas Foundation, the school that taught Obama how to organize. Alinsky was also the subject of Hillary Clinton’s undergraduate thesis.

So what is the Frankfurt School and how has had it shaped political thought on the left in America and possibly the world view of one of our candidates for President? The Frankfurt School was originally established in 1923 as the Institute of Social Research at Frankfurt University by Gyorgy Luckacs and other German communists. According to Pat Buchanan in his book Death of the West (pg. 75), it grew out of a recognition by them that “capitalism was not impoverishing the workers. Indeed their lot was improving, and they had not risen in revolution because their souls had been saturated in two thousand years of Christianity, which blinded them to their true class interests … In biblical terms, the word of Marx, seed of revolution, had fallen on rock-hard Christian soil and died … the Marxist had bet on the wrong horse.” In his work, History of Class Consciousness, Luckacs reiterated his commitment to dialectical materialism: “It is not men’s consciousness that determines their existence, but on the contrary, their social existence that determines their consciousness ... Only when the core of existence stands revealed as a social process can existence be seen as the product, albeit the hitherto unconscious product, of human activity." Translation: man’s social nature shapes the core of his existence, that is his consciousness. There is no room for God. To bring the world into alignment with this thinking, Luckacs “… saw the revolutionary destruction of society as the one and only solution. A world-wide overturning of values cannot take place without the annihilation of the old values and the creation of new ones by the revolutionaries.” Lukacs’s ideas became known as “cultural terrorism.” As the Hungarian Peoples Republic Commissar for Education and Culture, Luckacs put his program into action by instructing students in free love, the archaic nature of the middle-class family codes, rejection of monogamy, the irrelevance of religion, and called women to rebel against the sexual mores of the times. His basic aim was to destroy the institution of Christianity, which is the foundation of western culture. Fifty years later, these ideas were adopted by the baby boomers. Is this starting to sound familiar?

Antonio Gramsci, a contemporary of Luckacs, was an Italian communist, who also understood that traditional Marxism had failed. John Fonte of the Hudson Institute argues that Gramsci believed in “absolute historicism, meaning that morals, values, truth, standards, and human nature itself are products of different historical epochs. There are no absolute moral standards that are universally true for all human beings outside of a particular historical context: rather, morality is socially constructed.” In other words, truth and morality were not absolute, they were relative. Gramsci argued the culture must be changed, starting with the arts, cinema, theatre, schools, colleges, seminaries, newspapers, magazines, and the new electronic medium radio. Through these institutions the public could be captured and converted to the cause. He encouraged fellow Marxists to form alliances with Western intellectuals who embraced human secularism.

In 1930, Max Horkheimer (Traditional and Critical Theory) became the director of the Frankfurt School and the school began to systematically translate Marxism into cultural terms. Musician Theodor Adorno, psychologist Erich Fromm (Escape from Reason), and sociologist Wilhem Reich (The Mass Psychology of Fascism and The Sexual Revolution) joined the school. In 1933, Hitler’s rise to power interrupted the school’s development of its cultural Marxist ideology. The school relocated to America at Columbia University were it developed its Critical Theory, which has been described by Buchanan in DOW (pg.80) as the “essentially destructive criticism of all the main elements of Western culture, including Christianity, capitalism, authority, the family, patriarchy, hierarchy, morality, tradition, sexual restraint, loyalty, patriotism, nationalism, heredity, ethnocentricity, convention, and conservatism … the crimes of the West flow from the history of the West, as shaped by Christianity.” Buchanan then concludes, “Critical theory ultimately results in ‘cultural pessimism,’ a sense of alienation, of hopelessness, of despair where, even though prosperous and free, a people comes to see its society and country as oppressive, evil, and unworthy of its loyalty and love. The new Marxists consider cultural pessimism a necessary precondition of revolutionary change.”

During the fifties, Herbert Marcuse, an ex-OSS officer and Brandeis University professor, defined the proletariat of the American Cultural Revolution: radical youth, feminists, black militants, homosexuals, the alienated, and the asocial. His battle cry: “make love, not war.” In Carnivorous Society, he wrote: “One can rightfully speak of cultural revolution, since protest is directed toward the whole cultural establishment … there is one thing we can say with complete assurance. The traditional ideal of revolution and the traditional strategy of revolution have ended. These ideas are old-fashioned … what we must undertake is a type of diffuse and dispersed disintegration of the system.”

Critical Theory forms the basis of Western Marxism and post-modernist thought. Malcom X, Frank Marshall Davis, Saul Alinsky – all self-described by Obama as being influential in his life – studied and practiced the principles of Critical Theory. In his Rules for Radicals, a book that Alinsky ironically dedicated to Lucifer, "the very first radical" [2], Alinsky – Obama’s mentor – outlines his strategy in organizing, writing,

"There's another reason for working inside the system. Dostoevsky said that taking a new step is what people fear most. Any revolutionary change must be preceded by a passive, affirmative, non-challenging attitude toward change among the mass of our people. They must feel so frustrated, so defeated, so lost, so futureless in the prevailing system that they are willing to let go of the past and change the future. This acceptance is the reformation essential to any revolution. To bring on this reformation requires that the organizer work inside the system, among not only the middle class but the 40 per cent of American families - more than seventy million people - whose income range from $5,000 to $10,000 a year [in 1971]. They cannot be dismissed by labeling them blue collar or hard hat. They will not continue to be relatively passive and slightly challenging. If we fail to communicate with them, if we don't encourage them to form alliances with us, they will move to the right. Maybe they will anyway, but let's not let it happen by default."

Why haven't we heard anything about this in the media? The silence is deafening. Do you think we need to know more about Obama’s mentors, his world view, and how it came to be formed? He is asking us to place our country and its future in his hands. With such trust comes transparency. We are not getting that from the media or the man.

America is "being taken to school."

Tuesday, September 9, 2008

“Neighborliness” – The New Form of Social Redistribution of Wealth

Who are the “rich?” By “rich,” Obama means those who have been financially successful. This is distinction that deserves emphasis, because the term “rich” is not necessarily the same as being “financially successful.” To the average American, “rich” has a negative connotation, and it is easier to tax the “rich” than it is to tax success. In fact, many people are “rich,” but would not be classified as financially successful. For example Mother Teresa was rich but she was not what the world would claim to be financially successful. Second, it is important to distinguish exactly who Obama wishes to tax: those who have taken financial risks far beyond those of the average employee, who in many cases failed multiple times before succeeding, who worked hard, who invested in their businesses, and who created the jobs that ALL Americans enjoy.

The “rich” are typically people who either own businesses in America or receive employment from those businesses. From a demographics perspective, 80% percent of these businesses are sole proprietorships, partnerships, or S-Corporations (which are taxed at individual tax rates) and 20% are large C-corporations (which are taxed at corporate rates). The small businesses they own are recognizable in every town: gas stations, laundries, retail franchises, and other boutique family businesses. According to 10 Secrets that Millionaires Keep, by Daren Fonda of Smart Money, the financially successful, who have a net worth of $1M, are 90% more wealthy than other US households, earn on average $366,000 per year, and are in the top 1% of taxpayers. Their number has doubled since 2002, with half of them earning their wealth from small business, one-third from large corporations, and less than 3 percent through inheritance. Most come from families, which would not be classified as wealthy, and have enjoyed their financial success for less than 15 years. Their median grade-point average in college was 2.9, with an average SAT score of 1,190. Fifty-nine percent attended a state college or university. Their secrets to success, in their words: hard work, discipline, education, and treating others with respect. Other than their wealth, the “rich” seem to be a lot like the average American, except they have taken extraordinary risks, worked smarter and harder, and converted the opportunities presented to them into greater financial success.

How do the “rich” spend their money? Before they can spend it, they must pay taxes to the government. The top 1% of earners pay 40% of America’s federal income tax. In fact, the top 10% of earners pay 70%, and the top 50% pay 97%. Like all other wage earners, in addition to FICA, the “rich” pay 6.2% on their personal wages to fund social security, up to a maximum salary of $97,500 and 1.45% on all wages to fund Medicare. Because the average wage earner makes approximately $50,233 (2007 Census Bureau), the average wage earner pays, on average, $3,868 in payroll taxes. This is matched by the employer, who pays an additional $3,868. Under the current tax scheme, the financially successful, who earn over $97,500, will pay $7,459; however, fifty percent of them who own their businesses or are sole-proprietors will pay twice this, or $14,918, because they have to pay their own matching contribution. In effect they are paying 3.9 times more than an average wage earner working for a large corporation. These taxes are paid before any other taxes are paid. If Obama eliminates the cap on the Social Security payroll tax, so that all income is exposed to this tax, the average “rich” person who owns his own business will pay 12.4% on his or her full $366,000 in earnings or $45,384, or 3 times his or her current payroll tax level and almost 12 times that of the average American. This is before he or she pays increased marginal capital gains and income tax rates under the Obama plan (see Taxing the Rich is Really Taxing All of Us). Is this fair? It does not seem fair to me, especially in light of the fact that the financially successful person will never receive a payout from social security that even comes close to what was paid in. Based upon projections provided to me over the years by the Social Security Administration, I expect that I will receive approximately $1,500 per month in benefit. This will be substantially offset by income from other financial sources: in effect, my contribution will be transferred to others – simply another tax and redistribution of wealth.

So what does the financially successful person do with what is left? He or she invests it or spends it. Investment means capital formation that leads to further business growth and jobs. Spending includes both consumption and charitable contribution. Expenditure on consumption – you guessed it – creates jobs and opportunities for others to become financially successful. Charitable contributions meet the many social needs of our communities and fund that aspect of “neighborly” which can only be met by monetary investment. According to Arthur C. Brooks, of the American Enterprise Institute, charitable giving in America, which was $265B in 2006, has risen faster than the growth of the American economy over the past half-century. For example in 1995, “Americans gave per capita three and half times as much to causes and charities as the French, seven times as much as the Germans, and 14 times as much as the Italians.” The top ten percent of American earners are responsible for seventy-five percent of giving, and the top 1% of earners represents half of the giving. So who gives more, conservatives or liberals? According to Brooks, “The fact is that self-described ‘conservatives’ in America are more likely to give – and give more money – than self-described ‘liberals.’ In the year 2000, households headed by a conservative gave, on average, 30 percent more dollars to charity than households headed by a liberal. And this discrepancy in monetary donations is not simply an artifact of income differences. On the contrary, liberal families in these data earned an average of 6 percent more per year than conservative families.”

What are the implications of Obama’s tax policy? Simply put, instead of returning a tax rebate to wage earners based upon their contribution (viz., a rate reduction across the board), he proposes to tax the “rich” and return their tax receipts in the form of payments to a majority of Americans who pay little or no income tax. In effect, he is going to take from the financially successful – the backbone of the American economy – and redistribute the wealth to those who did not earn it to ostensibly meet their day-to-day “needs.” In the process, he will: (1) remove capital from the economy that creates opportunities and jobs; (2) drive down charitable contributions by individuals that fund truly “neighborly” projects and place decision making for social concerns in the hands of government rather than individuals; and (3) most importantly, destroy the incentive of financially successful people to compete in the marketplace while incenting those who are either unwilling or unable to compete to “vote” rather than work for their financial success. This is not capitalism; it is social Marxism.

Sunday, August 31, 2008

Global Warning on Global Warming

Recently, the American Water Resources Association (AWRA) held a three-day, 300-person conference at Regent University, in my hometown of Virginia Beach, VA. An objective of the conference was to create carbon offsets to mitigate the carbon footprint created by the conference attendees. To meet this objective, attendees planted 115 trees and shrubs on the campus. According to Al Todd, the conference committee’s chairman and a watershed program leader for the US Forest Service, the “carbon cost” of the conference, excluding air travel, was 15 to 20 metric tons of carbon dioxide. When confronted with the fact that one acre of forest can sequester between 0.5 and 2.5 metric tons of carbon dioxide annually, Todd admitted it would take 20 more years to offset the conference’s energy consumption. In his words, “We’ve got a lot of work to do, don’t we?”

This report makes you wonder if the AWRA accomplished anything in its three day conference other than planting trees. At a minimum it does suggest that before America commits all of its resources, energy, and economic prosperity to saving the planet and what some believe to be settled science, it would be prudent to ask ourselves some important questions. Principal among these are: “Is global warming real?” and “Does man’s activity contribute to global warming?” My conclusions are:

1. Yes, the planet is warming.

2. No, man’s activity has no appreciable impact on global warming. My conclusions are supported by a scientific study, Increased Effects of Increased Atmospheric Carbon Dioxide, by Robinson, A.B., et al, reviewed and endorsed by more than 9,000 Ph.D.s (http://www.petitionproject.org/) , and the testimony of David Evans, the scientist who wrote the carbon accounting model (FullCAM) that measures Australia’s compliance with the Kyoto protocol (http://mises.org/story/2571# and http://mises.org/story/2795 ).

My conclusions are supported by a scientific study, Increased Effects of Increased Atmospheric Carbon Dioxide, by Robinson, A.B., et al, reviewed and endorsed by more than 9,000 Ph.D.s (http://www.petitionproject.org/) , and the testimony of David Evans, the scientist who wrote the carbon accounting model (FullCAM) that measures Australia’s compliance with the Kyoto protocol (http://mises.org/story/2571# and http://mises.org/story/2795 ).

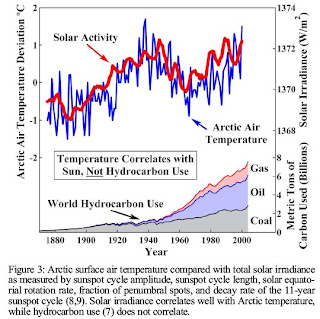

The conclusion of the Robinson research is that the earth is warming at a rate of 0.5 degrees Centigrade per 100 years, and that this trend is naturally occurring, as the earth recovers from what is referred to as the Little Ice Age. The current warming trend can be traced to about 1800. The researchers conclude that over the last 3,000 years, the earth’s temperature has varied within a 3 degree Celsius range. Arctic temperature variation correlates strongly with solar activity and not with world hydrocarbon use.

In fact, the study concludes that overall the climate has improved. The number of tornados has decreased, the number of hurricanes has remained constant, and rainfall has increased. During the past 50 years, atmospheric carbon dioxide has increased 22%, much of that due to human activity, but no correlation exists between temperature increase and carbon dioxide production. In fact the major effect has been to increase plant growth and biological diversity (that is, a positive effect).

The results of this study are confirmed by David Evans, one of the principals behind the global warming theory. His conclusions:

“After further research, new high-resolution ice core results (data points only a few hundred years apart) in 2000–2003 allowed us to distinguish which came first, the temperature rises or the CO2 rises. We found that temperature changes preceded CO2 changes by an average of 800 years. So temperature caused the CO2 levels, and not the other way around as previously assumed. The world should have started backpedaling away from blaming carbon emissions in 2003."

"There are several possible causes of global warming, and they each warm the atmosphere at different latitudes and altitudes — that is, each cause will produce a distinct pattern of hot spots in the atmosphere, or ‘signature.’ The greenhouse signature is very distinct from the others … There is no hotspot in the tropics at 10 km up, so now we know that greenhouse warming is not the (main) cause of global warming — so we know that carbon emissions are not the (main) cause of global warming.”

So what are the potential effects of global warming? I am not sure we know yet, except that the effects will not be principally due to man-made carbon dioxide production. In fact, by committing our resources, energy, and economic future to eliminating carbon production, we will deliberately make the situation worse. The well being of our society, the well being of the world, and the solution to the real effects of global warming depend upon low cost, abundant energy sources, of which carbon-based fuels is the backbone and will be the backbone for the next twenty years.

My solution is to develop ALL energy sources, including alternative energy sources and conservation. In the near term, we need to drill in America. We need to further develop natural gas and nuclear to build an energy bridge to the future. As I have documented in prior blogs, alternative energies, today, will not provide our energy need – they only satisfy a psychological need. Unfortunately, that psychological need is not based on science.

Wednesday, June 25, 2008

Speculating on Speculation

First, let me say I am not an expert in this area by any means. However, in my consulting practice, I did assist a large energy marketing firm re-engineer its business processes, and through this experience, did come away with a good appreciation for what drove their business.

Energy marketing has nothing to do with selling energy. In fact, the objective of the business is to never, never … ever … to end up having to fulfill a physical contract. That is true: other companies deliver the product. The energy marketers job is price discovery: to predict the future price of a commodity, in this case energy, and buy and sell contracts that profit on the uncertainty in the market price. The politicians would have us believe this is “reckless wagering,” except behind each “bet” is market knowledge (actual data), information gathering (information technology), forecasting (sophisticated statistical analysis), and risk management (arbitrage and hedging). On every “wager,” there are at least two sides to the transaction – a party that will ultimately win and one that will ultimately lose, both of which are intelligently looking at the market. So, when large uncertainty in the price exists, large uncertainty in the underlying ability of the market to meet supply and demand exists. If there were no uncertainty, no price volatility would exist nor would any profit potential for an energy marketer.

The real question is “what is driving the risk?” Prospectively, I believe the energy marketers believe the answers are: (1) world demand is starting to outstrip supply (see my blog “To Drill or Not to Drill, That is the Question”), (2) America consumes a disproportionate share of the oil resource, which drives world price, and (3) America will elect a president and congress that: (a) will withdraw from Iraq, leaving 60% of the worlds oil supply in the hands of our adversaries, (b) are not willing to tap potential sources of energy within our borders; and (c) will not commit to proven energy technologies but will replace them with less dense, passive technologies and conservation that will never meet our energy needs. In short, oil is in short supply and we do not want to do anything to increase that supply except talk. We need the oil and some else owns it. My bet is the price is going to go up.

So, the moral to the story is this. When the “speculator” watchdog starts barking, let’s shoot it. Or as John Preston, of Boston University, said “The nicest thing about not planning, is that failure comes as a complete surprise and is not preceded by a period of anxiety.”

Tuesday, June 24, 2008

To Drill or Not to Drill, That is the Question

Production and Consumption. Fortunately, someone has provided us with a scientific (versus political) analysis of oil production over time. In 1998, Richard C. Duncan and Walter Youngquist forecast the world peak in oil production, “which will be a turning point in human history.” Their results are presented a series of three papers (referred to by them as Issues #1, #2, #3) entitled the World Petroleum Life Cycle , which was presented to the Petroleum Technology Transfer Council. Their methodology uses historic oil production data from the top 42 oil producing countries and statistical and heuristic modeling techniques. The 1998 paper (Issue #3), predicted that the peak in world energy production would occur in 2006. Prior analyses in 1996 (Issue #1) and 1997 (Issue #3) predicted a peak in world production in 2005 and 2007, respectively. The conclusions from this study are:

Production and Consumption. Fortunately, someone has provided us with a scientific (versus political) analysis of oil production over time. In 1998, Richard C. Duncan and Walter Youngquist forecast the world peak in oil production, “which will be a turning point in human history.” Their results are presented a series of three papers (referred to by them as Issues #1, #2, #3) entitled the World Petroleum Life Cycle , which was presented to the Petroleum Technology Transfer Council. Their methodology uses historic oil production data from the top 42 oil producing countries and statistical and heuristic modeling techniques. The 1998 paper (Issue #3), predicted that the peak in world energy production would occur in 2006. Prior analyses in 1996 (Issue #1) and 1997 (Issue #3) predicted a peak in world production in 2005 and 2007, respectively. The conclusions from this study are:- Prediction 1: “Compounding world energy demands will be increasingly industrialized nations (particularly SE Asia, China, and India) wanting more energy per capita. China, Southeast Asia, and India now with some 60% of the world’s population are getting motorized wheels. If China used oil on a per capita basis as does the United States, China alone would be responsible for approximately 14 million barrels a day more than the present world’s entire world oil production.” [emphasis mine]

- Prediction 2: “A recent analysis by the Centre for Global Energy Studies (CGES), London, using a technique called logistic curve analysis, created one scenario in which even if non-OPEC countries discovered a further 500 billion barrels of oil, non-OPEC production would peak in about 2002 at 50 million barrels per day and decline more rapidly under conventional analysis. We are in full agreement with the CGES about the nearing of the non-OPEC peak.”

- Prediction 3: “Issues #1 through #3 of the Program predicted the world peak in the tight range of 2005 to 2007. However, Issue #3, Section 5, entitled ‘Can We Delay the World Oil Peak?” … concluded, ‘Yes, new production brought on stream well before the 2006 base-line peak can delay it, but only by few billion barrels of new production. However, even large increments of new production brought on after the peak is not likely to have any effect whatsoever on delaying the base-line world oil peak.” CGES’s review noted that oil production was once expected to peak in the 1980s, but has been successively pushed back into the first decade of the next century. However, CGES concludes that the peak may not be pushed back much further. “We are in full agreement with the CGES about the inertia of the world oil peak.”

- Prediction 4: Any oil strike in the former soviet socialist republics surrounding the Caspian Sea would be modest, contributing about 3% of the world’s oil supply. By contrast the Middle East holds about 60% of the world’s oil supply.

Remember these predictions were made in 1998. Based on the US government’s Energy Information Administration forecast (2007), historical consumption is shown in the graph to the left. In 2007, world consumption was 31Gb per year, which was what was projected.

Remember these predictions were made in 1998. Based on the US government’s Energy Information Administration forecast (2007), historical consumption is shown in the graph to the left. In 2007, world consumption was 31Gb per year, which was what was projected.So, what does this analysis tell us:

· Based on 1998 estimates of technology capability, historical production rates, and forecasting techniques, we have reached peak world production, and the production market is now driven by OPEC countries.

· Production is in decline. It could have been mitigated but not reversed, by additional drilling as soon as possible.

· As production declines and demand from China and India increase, the law of supply and demand will drive oil commodity prices up. Prices will be driven higher by uncertainty of supply due to perceived and real threats to supply. Clearly, energy “speculation” (viz., trading) is driving up prices in the short-term; however, trading tends to discount future volatility in a market and therefore is a pre-cursor of a larger, looming problem.

Beyond the oil forecast, other historical facts are relevant to a decision to drill or not drill.

· Due to environmental protectionism, the United States currently sits on the world’s second largest coal supply (China is first). The United States coal supply is adjudged by some to contain three times the energy content of proven OPEC oil reserves, which comprise 60% of the world’s known oil reserves.

· United States Oil consumption is approximately 20 million barrels per day (7.3 billion per year) of which 50% is imported.

· The United States has known reserves of 86 billion barrels of oil offshore, of which 85% is off limits to drilling. This is equivalent to 12 years of total energy needs, or 24 years of imported needs, at current consumption rates.

· China is currently drilling off our coast, but we are not allowed to.

· Since 1998, the United States has developed new methods of exploring for oil, deep ocean drilling techniques, technology to recover sand tars, and methods for extracting oil from shale. This has opened up additional potential areas for energy recovery, including areas in the Rockies, Wyoming, Montana, and parts of the Dakotas. Although I have not researched this, my understanding from media reports is that exploration in these areas will require permission from the Federal government, much like the current situation in Anwar.

· During the 1960s and 1970s, nuclear power was commercialized in the United States, with the intention of producing low cost electrical energy, which would make electric residential heating and electric vehicles abundant and cheap. Where utilities have been allowed to commercially operate nuclear plants, in spite of their excessive regulatory cost, they are the lowest priced sources of electrical energy and are operated as base-loaded facilities.

· The United States is ranked 8th in the world in proven uranium reserves; Australia is ranked 1st and Canada is ranked 3rd.

· No new plants have been ordered in the United States since the late 1970s because of environmental activism. At that time, America was the world’s technology leader in the commercialization of nuclear power, which we ceded to the French and Germans. Today, France is 80% nuclear.

· Starting in the 1970s and until this year, the environmentalist have opposed nuclear power through political activism, fear, quack science, and distortion of the the facts. In the meantime, the existing 104 commercial nuclear units are reaching their end of useful life. Now, the high priests of environmentalism have declared nuclear to be green. As of this writing 14 applications have been made within the last year to the Nuclear Regulatory Commission for new plants. Unfortunately, burial of the waste at Yucca Mountain is mired in red tape and will not open until at least 2017, almost 40 years after discussion of this project started.

My conclusions are:

· In the near term we need to drill everywhere it is technically and economically feasible. Our economy and physical security rely on the internal combustion engine, and that technology will not be replaced for many years to come, no matter what alternative energy sources we develop. To address environmental concerns, we can let the Norwegians and the Danes do it. Apparently, like the French who mastered nuclear power and we could not for political reasons, the Scandinavians have safely and economically continued to explore, exploit, and place into production offshore oil drilling.

· Due to the ideology of environmentalism, we have missed the opportunity to bridge our economy from an oil based one to a nuclear one. We should license and build as many plants as we can. Because the average age of the nuclear thought leadership in this country is approximately 53 years and is retiring, we can ask the French and Chinese to head up this project.

· Offshore drilling restrictions should be relaxed. Funds from the lease of these properties should be put into technologies that show near term promise: nuclear, clean coal, fuel cells, and electric vehicles, especially battery technology. The energy density of solar and wind is not sufficient to provide the backbone of our energy infrastructure (see prior blogs). These technologies, with conservation, do have a place in the energy mix, but will never be more than 10 to 20% of our total energy supply.

· Put in place long term (10,20, 30 year) incentives to achieve energy independence goals.

· Learn from our mistakes. Environmental ideology and politics of fear prevented us from developing a critical technology, nuclear power. Since the 1970s, the French and Germans have been the technical leaders in this field and the principal suppliers of technology to others, including Pakistan, Iran, Iraq, and Libya. These nations not only control the oil but also now seek to develop nuclear weapons. They are not only a threat to our energy security, they are now a threat to our physical security.

Just like many other aspects of our society, energy policy in this country has been hijacked by those on the left. In fact, they are as bad if not worse than the energy traders, whose “speculation” simply quantifies in monetary terms what is otherwise bad policy and the inevitable consequences of ignoring the laws of supply and demand. By historically preventing the development of commercial nuclear power in this country, the environmentalist have effectively destroyed our “energy bridge” to the future. Now, we are in a declining oil-based market, where production has peaked, demand is increasing, and prices will certainly rise. Just like a “speculator,” the environmental left has created a perfect “straddle.” By now declaring nuclear environmentally safe, they have now given the “green” light to develop a technology supported by an aging infrastructure, an aging workforce, a mind numbing spider’s web of regulation, and nowhere to bury the waste. When this fails to address our energy needs in a timely manner, they will simply state it wasn’t their fault, and continue to push their agenda to develop passive energy technologies that do not have the energy density to meet the needs of a growing, technologically competitive society. For the environmental left, it is all about ideology and the science of the probable; it is not about common sense and the science of the possible.

Thursday, June 19, 2008

A Cure for Energy Depression – More Sun?

In prior postings, I have tried to provide you with the basic facts, so that you could follow my logic and conclusions. However, in this case, I have the facts straight from a proponent of solar energy: so, you don’t have to believe me, you can believe them.

The Montana Green Power (MGP) organization (http://www.montanagreenpower.com/) has produced a series of lessons to promote “green energy” in the schools. Lesson 8, “Are PV [Photovoltaic] Systems Cost-Effective?” This lesson has three objectives: (1) analyze the costs related to PV; (2) calculate the environmental cost savings of PV compared to fossil fuels; (3) investigate tax incentives or rebates [I guess they mean subsidies] that would make PV systems more affordable.

With respect to cost, the MGP lesson plan states:

“Today in Montana, a 2- to 4- kilowatt (kw) grid-intertied [viz., connected to the power grid] PV system will have an installed cost of between $9 and $16 per watt, with electricity produced over the life of the system costing 25 to 30 cents per kw-hour. In comparison, residential electricity purchased from the utility grid costs about 7 cents per kw-hour.

“We must also consider hidden environmental costs, called external costs. While the above information suggests that fossil fuels are much cheaper than renewable energy, consider these facts [emphasis mine]:

- Extracting fossil fuels causes environmental damage from the extraction equipment and from the pollution that is a by-product of burning those fuels.

- Fossil fuels are not free. They cost money to bring out of the ground. This means as fossil fuels run out, their price will increase.

- Fossil fuels give off gases whey they are burned. Most of these gases – sulfur oxides, nitrous oxides, and carbon dioxide, for example – may be [emphasis mine] causing a change in the global climate, sometimes, green house effect, climate change, or global warming.”

Let’s look at the stated financial benefit of solar, and put it in context. The installed cost is all cost required to design the system, purchase its components, purchase the site, install the components, and bring the system to the point of commercial operation. In the case of solar, this cost is $9 to $16 per watt. Using an average of $12.50 per watt, this is equivalent to $12,500 per kilowatt (kw). According to an article by Matthew Wald of the International Herald Tribune, “Price of new power plants rises sharply,” July 10, 2007, quoting a Duke Energy spokesman, he reported that it would cost $1.83 billion to build a new 800 Mw fossil plant, which represents a cost of $2,288 per kilowatt. The same article reported the cost of a nuclear plant to be in the same range: $2,000 to $3,000 per kw. In other words, a solar facility with the same capacity is more than five times as expensive to build as a modern fossil plant, with full environmental controls.

To check my facts, I went to a source where you would expect the source to be biased in favor of alternative energy sources: the California Energy Commission. They reported the capital cost of the following energy sources:

If you believe California, PVs are more cost competitive, but still twice the cost of fossil: just for the equipment.

If you believe California, PVs are more cost competitive, but still twice the cost of fossil: just for the equipment.From an operating perspective, GMP reports that the ongoing cost of solar generation is 25 to 30 cents per kw-hour compared to 7 cents per kw-hour for fossil generation, or 4 times as expensive.

What about energy density? In a prior posting, I compared the energy density of fossil generation to the energy density of wind power. A 2,259 Mw fossil plant requires 800 acres (TVA’s Paradise Fossil Plant). Assuming that the fossil plant operates 70% of the time, then in one year it generates 17,315 Mw-hr/acre-year. To calculate the energy density of solar, the 1 – axis, tracking, flat-plate collector with a north-south axis data published by the National Renewable Energy Laboratory (http://www.nrel.gov/rredc/) was assumed, with the collector oriented relative to the horizon at latitude – 15 degrees. For Helena, Montana, the 30 year average of monthly, solar radiation, 1961 – 1990 is 6.3 kw-hr/meter square – day. Assuming 10.76 square feet per meter, 43,560 square feet per acre, and 365 days per year, solar radiation at the surface of the PV array is 9,309 Mw-hr/acre-yr. However, one must consider the conversion efficiency of the PV – its ability to take the solar radiation falling on it and convert it to electricity. According to Wikipedia, solar cell conversion efficiency for commercially available solar cells is 14% to 19%. Assuming 17%, then the energy supplied by a solar array in Helena, Montana, is 1,582 Mw-hr/acre-year. Therefore, fossil power is almost 11 times more efficient, from an energy density perspective, than solar power. In more practical terms, if you want to supply the energy requirements for 100,000 people, you can either build an 800 acre fossil plant or an 8,800 acre solar plant.

But GMP claims we should consider other external costs. But should we? The cost of mining coal, burning the coal, and meeting all the environmental standards is included in the cost of operations: 7 cents per kw-hr. It should not be included twice in the comparison, unless the objective is to kill the technology and one is willing to pay 4 times the price for solar. With respect to gas emissions, it is not scientifically proven that global warming is even occurring. If it is, the extent to which man’s activities contribute to it certainly has not been established. In fact, some studies suggest that volcanic activity and even cows contribute more to greenhouse gas than does man.

According to the American Coal Foundation, “Coal supplies in the United States are far more plentiful than domestic oil or natural gas; they account for 95 percent of the country's fossil fuel reserves and more than 60 percent of the world's fuel reserves. The United States has about 275 billion tons of recoverable coal, which could last us more than 250 years if we continue using coal at the same rate as we use it today. In addition, the United States has more than 25 percent of the world's estimated coal reserves.” Some estimate that America’s coal reserves, in terms of energy content, are more than three times that of the Saudian Arabia oil reserves.

In conclusion, when solar generation is compared to fossil generation, solar is five times more expensive to build, four times more expensive to operate, and requires eleven times as much land. The threat to the environment is at best unproven and at worst is overstated. Solar proponents are really using fear to advocate an ideological position that is not supported by the economics. That said, solar does have a place in the energy mix. In locations where there is high solar radiation for long periods of time and the location is not proximate to the existing electrical grid, solar may prove economic. Otherwise, let the free market rule: if an individual wants to make a commitment to the technology for personal reasons let him or her do so. No compelling basis exists to create a public policy that must be funded by the rest of us at a substantially greater cost.

The cure for energy depression is less sun.

True Colors – The Re-run

Similarly, social progressives (“democrats”) ("Peter") have spent the past fifty years manipulating the American people ("Tim") and the truth to achieve their conversion of a capitalistic America to a socialistic America. They are starting to demonstrate their “true colors.” And we have it on surveillance tape (http://www.youtube.com/watch?v=PUaY3LhJ-IQ&feature=related) at least when it comes to their understanding of how America’s energy policy and markets should work.

The brouhaha started about two weeks ago, when Congresswoman Maxine Waters (D-CA) challenged the President of Shell Oil, John Hofmeister, to guarantee the American people that the prices they pay at the pump will go down if the oil companies are allowed to drill wherever they want off of US shores. Mr. Hofmeister responded, “ I can guarantee to the American people, because of the inaction of the United States Congress, ever increasing prices unless the demand comes down and five dollars will look like a very low price in the years to come if we are prohibited from finding new reserves and new opportunities to increase supplies.” To which, Ms. Waters responded, “ Guess what this liberal would be all about. This liberal will be all about socializing … ahhh, ahhh, (3 second pause), will be about (3 second pause), basically taking over and the government running all of your companies.” The word that this social progressive could not find in her vocabulary was “nationalize.” Not to be outdone and to clarify the record, on June 18, 2008, Maurice Hinchey (D-NY), explicitly stated the social progressives’ intent: “So if there is any seriousness about what some of our Republican colleagues are saying here in the House and elsewhere about improving the number of refineries, maybe they would be willing to have these refineries publicly owned by the people of the United States so that the people of the United States can determine how much of the product is refined and put out on the market. To me that sounds like a very good idea.” It sounded so good, that Malia Lazu, of Oil Change International, an Obama supporter, unequivocally stated that the oil companies should be taken over by the government.

So there it is. The democrats’ strategy is to nationalize … or euphemistically, socialize, if you listen to the eloquence of Maxine Waters … a major segment of the United States economy because, at the core of it, they do not understand basic economic theory. I guess when all you have in your tool chest is a hammer, all problems look like a nail. Hopefully the government will be able to “nationalize” the oil industry better than they have regulated the commercial nuclear electric industry, which they managed to kill. After almost 30 years of discussion on the burial of nuclear waste at Yucca Mountain, we are still 8 to 11 years away from a final decision. In the meantime, France has no problem with nuclear waste: they have been vitrifying it for 20 years, and now nuclear power represents 80% of their electricity production.

Unfortunately, no rational, prospective decision will be forthcoming from the “democrats.” Generally, they do better when a lot of polling data and prior historical data exist, which they can second-guess. Hindsight is always 20-20. However, when pushed to make a critical decision, rest assured they will show their “true colors.”

Tuesday, June 17, 2008

A New Idea – Tax the “Poor!”

I was intrigued, so I asked him how it worked. He illustrated TTBB with a story. “Suppose,” he said, “that you and I were contenders for the world heavyweight boxing title. To improve my chances of winning, I hired a world-renowned trainer and asked him for his advice. He stated that, after some reflection, you and I were the same weight, had the same reach, and had the same record. Despondent, I asked how I could possibly beat you. He quickly responded, "Hit him below the belt." Appalled, I retorted, "But that is illegal!" To which he responded, "Contact is illegal. Fake a punch to the groin with your left, he will try to protect himself with his right, which will allow you to use your left hook, which is your best punch."

So what does this have to do with my idea of taxing the poor? Well, we all know that traditional wisdom would say this proposition is ridiculous on its face: the poor need money. They do not have money. However, if you apply TTBB and relax all constraints, evaluate all possibilities, put together a plausible alternative, and then re-evaluate the constraints, you can devise creative, plausible alternatives where none initially appear to exist. In this case, what the poor have is time, not money.

So the thinking goes like this. The revenue to the federal treasury is estimated to be $2.7 trillion dollars per year in 2008. In 2006, the population was estimated to be almost 300 million, with approximately 75% over the age of 18, or about 225 million. Approximately 37 million of these are over 65. Approximately 50% of all taxpayers’ pay 100% of all tax, which means 50% of the people pay nothing but receive their pro rata share of the benefits, at a minimum. So, if one assumes all persons over the age of 18 are beneficiaries of this wonderful system, then the “benefit” [50% of $2.7 trillion] to the 50% not paying taxes [50% of 188 million (225 million over age 18 less the 37 million over age 65], represents $14,361 per person not paying tax. Imputing to these individuals a median income of $38,387 [2006, Heritage Foundation, which really represents a "raise" for their time, because they are in the lower 50% of the income pool] and a work year of 1,928 hours [2,080 hours per year, less 2 weeks vacation, and 9 holidays), this equates to 721 hours per year to pay for their benefits.

So, here is my proposal. Require those over the age of 18 and less than 65, who pay no taxes whatsoever, to contribute only 416 hours per year (one day per week, not the 721 they “owe”) to the rest of us, who are paying the taxes. This time can be “donated” in a variety of ways. Several come to mind immediately: participating in rehab; working on their GED; serving in the military reserves; picking up trash. I am open to any activity which has the following features: (1) the work must contribute to the betterment of the individual, the community, and the country (responsibility); (2) the work must be performed EVERY week at a standard time (discipline); (2) the work must be supervised (accountability); (3) the work must be performed until either mutually agreed goals are achieved or the individual becomes a tax payer (results). Maybe, just maybe, some of these folks will be so successful, they will end up owning their own business and experience first hand the “privilege” of making payroll, week in and week out, and reducing the tax burden on the rest of us.

A Recipe for Economic Disaster: Coming to Your Home Soon

Individual Tax Increases. With Bush’s tax cuts scheduled to expire in 2011, Congress will be under pressure to pass legislation to extend or replace them. Obama opposes continuance of these tax cuts and, with a social progressive (“democratic”) majority in the house and senate, will most likely eliminate them. This action will increase income taxes on “hard working Americans” in the top two tax brackets, raising the marginal rate on ordinary income from 35% to 39.6%, according to William Ahern, spokesman for the Tax Foundation, a nonpartisan research group. Mr. Ahern also asserts, as does Senators Wayne Allard (R-CO) [source: Amendment 4246 to the senate budget bill (3/14/2008)] and

Individual Tax Increases. With Bush’s tax cuts scheduled to expire in 2011, Congress will be under pressure to pass legislation to extend or replace them. Obama opposes continuance of these tax cuts and, with a social progressive (“democratic”) majority in the house and senate, will most likely eliminate them. This action will increase income taxes on “hard working Americans” in the top two tax brackets, raising the marginal rate on ordinary income from 35% to 39.6%, according to William Ahern, spokesman for the Tax Foundation, a nonpartisan research group. Mr. Ahern also asserts, as does Senators Wayne Allard (R-CO) [source: Amendment 4246 to the senate budget bill (3/14/2008)] and  Richard Burr (R-NC) that the social progressives have proposed more spending than could be paid for by the tax increases they have discussed. According to Ahern, “they are likely to seek even higher taxes.” [source: The tax Foundation, “Summary of the Presidential Candidates’ Tax Plans”]. In contrast, Sen. McCain not only intends to make the tax cuts permanent, he has stated that he would reduce the corporate tax rate, now 35%, to 25% in a bid to stimulate the economy.

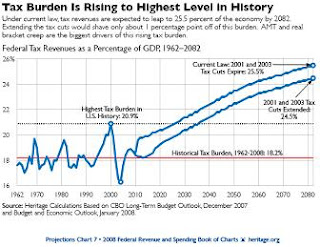

Richard Burr (R-NC) that the social progressives have proposed more spending than could be paid for by the tax increases they have discussed. According to Ahern, “they are likely to seek even higher taxes.” [source: The tax Foundation, “Summary of the Presidential Candidates’ Tax Plans”]. In contrast, Sen. McCain not only intends to make the tax cuts permanent, he has stated that he would reduce the corporate tax rate, now 35%, to 25% in a bid to stimulate the economy. AMT. The Alternative Minimum Tax (AMT) "was created in 1969 to target 21 -- yes, 21 -- millionaires who had managed to avoid paying any taxes at all. According to the Wall Street Journal, April 14, 2007) more than three million taxpayers were affected by the Alternative Minimum Tax on their 2006 income. The Wall Street Journal estimated that the number could rise to 23 million in 2007. In fact, it did not, only because Congress passed a so-called "patch" to prevent it. This year, the AMT “adjustment” to index the tax to inflation will potentially cost taxpayers $63 billion. McCain has stated he would phase out the AMT (www.JohnMcCain.com). Obama voted not to repeal it but has yet to provide more detailed plans. Obama has criticized McCain for not specifying how he would pay for the revenue reduction associated with the loss of the AMT; however, McCain has responded that he would entertain a fair tax or flat tax that have as one of their objectives the elimination of the IRS as we know it. The IRS employs 91,000 employees with an annual budget of $11.4 billion. The Cato institute estimates that business and individuals spend 6.4 billion hours per year in tax compliance, which the Tax Foundation estimated to be worth $265.1 billion in 2005. Between these two expenses, McCain should be able to cut $65 billion and “re-purpose” (a government euphemism for spend) the rest. Tacitly assumed in Obama’s argument is the assumption that every penny needs to be replaced, as though it is well spent. In 1993, the General Accounting Office (GAO) audited the IRS for the first time in its history and found widespread evidence of financial malfeasance and gross negligence, including the fact that the agency was unable to account for 64% of its congressional appropriation.

AMT. The Alternative Minimum Tax (AMT) "was created in 1969 to target 21 -- yes, 21 -- millionaires who had managed to avoid paying any taxes at all. According to the Wall Street Journal, April 14, 2007) more than three million taxpayers were affected by the Alternative Minimum Tax on their 2006 income. The Wall Street Journal estimated that the number could rise to 23 million in 2007. In fact, it did not, only because Congress passed a so-called "patch" to prevent it. This year, the AMT “adjustment” to index the tax to inflation will potentially cost taxpayers $63 billion. McCain has stated he would phase out the AMT (www.JohnMcCain.com). Obama voted not to repeal it but has yet to provide more detailed plans. Obama has criticized McCain for not specifying how he would pay for the revenue reduction associated with the loss of the AMT; however, McCain has responded that he would entertain a fair tax or flat tax that have as one of their objectives the elimination of the IRS as we know it. The IRS employs 91,000 employees with an annual budget of $11.4 billion. The Cato institute estimates that business and individuals spend 6.4 billion hours per year in tax compliance, which the Tax Foundation estimated to be worth $265.1 billion in 2005. Between these two expenses, McCain should be able to cut $65 billion and “re-purpose” (a government euphemism for spend) the rest. Tacitly assumed in Obama’s argument is the assumption that every penny needs to be replaced, as though it is well spent. In 1993, the General Accounting Office (GAO) audited the IRS for the first time in its history and found widespread evidence of financial malfeasance and gross negligence, including the fact that the agency was unable to account for 64% of its congressional appropriation. Corporate Taxation. Obama is in favor of raising the current 15% tax rate on long-term capital gains and dividends to 28%. Raising the tax rate would lower after-tax returns on equities, just as baby-boomers enter retirement, further impacting their retirement incomes, as well as throwing a wet blanket on the economy, as it is trying to avoid recession. Obama also advocates treating dividends as ordinary income. McCain has pledged to keep current rates on dividends and capital gains at their present level. “When rates are low, companies pay out more retained earnings and dividends, and dividends spur economic growth as investors plow the money back into other companies,” says Raj Chetty, professor of economics at UC-Berkley, who has studied how corporations respond to a favorable dividend rate.

Corporate Taxation. Obama is in favor of raising the current 15% tax rate on long-term capital gains and dividends to 28%. Raising the tax rate would lower after-tax returns on equities, just as baby-boomers enter retirement, further impacting their retirement incomes, as well as throwing a wet blanket on the economy, as it is trying to avoid recession. Obama also advocates treating dividends as ordinary income. McCain has pledged to keep current rates on dividends and capital gains at their present level. “When rates are low, companies pay out more retained earnings and dividends, and dividends spur economic growth as investors plow the money back into other companies,” says Raj Chetty, professor of economics at UC-Berkley, who has studied how corporations respond to a favorable dividend rate. Social Security, Medicare, Medicaid. Neither candidate has proposed definitive approaches to solving the Medicare and Social Security issues facing the country. If healthcare costs continue to outpace the growth in GDP, do not expect the estate tax, which is scheduled to be reinstituted and jump from 0% in 2010 to 55% in 2011 for estates over $1M, to close this gap. McCain has suggested he would support higher exemption levels and lower tax rates: a 15% estate tax with a $10 million exemption for couples. Obama has no plan other than to let the tax expire. According to Sandra Day O’Connor (former Supreme Court Justice) and James R. Jones (former Ambassador to Mexico), in their OpEd piece “What we owe our young,” Virginian Pilot, June 17, 2008, “Even if every dollar of wealth of every millionaire in the United States were magically diverted to pay these costs [Social Security, Medicare, and Medicaid bill that are coming due over the next several decades], 80 percent of the unfunded liabilities forecast for these three programs would remain on the books.” [Emphasis mine]

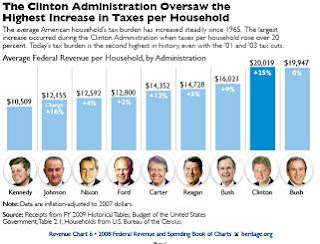

Social Security, Medicare, Medicaid. Neither candidate has proposed definitive approaches to solving the Medicare and Social Security issues facing the country. If healthcare costs continue to outpace the growth in GDP, do not expect the estate tax, which is scheduled to be reinstituted and jump from 0% in 2010 to 55% in 2011 for estates over $1M, to close this gap. McCain has suggested he would support higher exemption levels and lower tax rates: a 15% estate tax with a $10 million exemption for couples. Obama has no plan other than to let the tax expire. According to Sandra Day O’Connor (former Supreme Court Justice) and James R. Jones (former Ambassador to Mexico), in their OpEd piece “What we owe our young,” Virginian Pilot, June 17, 2008, “Even if every dollar of wealth of every millionaire in the United States were magically diverted to pay these costs [Social Security, Medicare, and Medicaid bill that are coming due over the next several decades], 80 percent of the unfunded liabilities forecast for these three programs would remain on the books.” [Emphasis mine]America’s problems are grave. However, proposing new spending and raising tax rates to cover them is only a band-aid fix: they must be seriously addressed. Taking money out of the hands of “hard working” Americans and putting them in the hands of politicians has resulted in a 334% increase in Federal spending since 1965 (from $628 billion to $2.7 trillion in 2007 inflation adjusted dollars), while the median income of the average American has risen 35% ($28,346 to $38,386). Over this period, mandatory spending on entitlement programs has grown from 26.9% of the budget to 52.9% of the budget. When interest is considered (8.3%), only 38.8% of the budget is discretionary (within the control of the President). A better solution is to take the decision making out of the hands of a do-nothing, socially progressive government and let the average “hard working” American decide for himself or herself how to spend his or her income. Clearly, Obama’s proposals would make this much, much more difficult.

For additional information on this subject, see the Heritage Foundation, 2008 Federal Revenues and Spending Book of Charts, at:

http://www.heritage.org/research/features/budgetchartbook/index.html

Saturday, June 14, 2008

Statistics Are Not a Substitute for Good Judgment

Suppose, just suppose, that the media, 85% of which proudly describe themselves as “liberals,” are using the polls to test the effectiveness of their message. My understanding is that five major companies control what we hear and read. They fill their 24 by 7 cable networks and radio talk shows with “information,” which must be obtained as quickly as possible and is poorly vetted (i.e., the erroneous reporting on the deaths in the Katrina disaster). This information is filtered through their biased world-view (i.e., the fabricated stories in the New York Times). Then, they perform polls to see if their message is being received! Based on the polls, they refine their message.

As Benjamin Franklin said, freedom of the press belongs to him who owns the press. Joseph Goebbels, Hitler’s Propaganda Minister, further emphasizes the point:

“Success is the important thing. Propaganda is not a matter for average minds, but rather a matter for practitioners. It is not supposed to be lovely or theoretically correct. I do not care if I give wonderful, aesthetically elegant speeches, or speak so that women cry. The point of a political speech is to persuade people of what we think right. I speak differently in the provinces than I do in Berlin, and when I speak in Bayreuth, I say different things than I say in the Pharus Hall. That is a matter of practice, not of theory. We do not want to be a movement of a few straw brains, but rather a movement that can conquer the broad masses. Propaganda should be popular, not intellectually pleasing. It is not the task of propaganda to discover intellectual truths.”

So, the next time you consider the import of a poll, remember the poll was commissioned by a select group of people – people who control the channels of media communication, who have a world-view bias, who educated the respondees on the subjects for which they are requesting an opinion, and whose success is measured by ratings.

Statistics are never a substitute for good judgment!

Friday, June 13, 2008

Searching for New Sources of Energy and Looking in all the Wrong Places

Serendipitously, I came across a 2006 USA Today article “Feds: Obesity Raising Airline Fuel Costs,” in which USA Today suggests, based on a 2000 Center for Disease Control study, that the 10 additional pounds gained by the average American in the 1990s, costs the American airlines an additional 350 million gallons of fuel per year and produces 3.8 million additional tons of carbon dioxide. The article states that this represented a fuel price increase of $275 million. I was “flabbergasted,” pardon the pun, which resulted in an epiphany. What if I could turn “flab” into “gas?”