Now that we are facing an energy crisis, the social progressives (“democrats”) are doing what they do best: reinforcing their message that we are all “victims” and are “entitled” to all the energy we want at a price we can afford. The most recent target is the “speculators,” formerly known in more respectable times as “energy traders.” The social progressives answer – surprise, surprise: regulate them. Unfortunately, regulation will do nothing to address the underlying issue, except to eliminate what is a useful market function that provides us with an early warning of impending market movement (both good and bad) and counterbalances the market alternative, cartels.

First, let me say I am not an expert in this area by any means. However, in my consulting practice, I did assist a large energy marketing firm re-engineer its business processes, and through this experience, did come away with a good appreciation for what drove their business.

Energy marketing has nothing to do with selling energy. In fact, the objective of the business is to never, never … ever … to end up having to fulfill a physical contract. That is true: other companies deliver the product. The energy marketers job is price discovery: to predict the future price of a commodity, in this case energy, and buy and sell contracts that profit on the uncertainty in the market price. The politicians would have us believe this is “reckless wagering,” except behind each “bet” is market knowledge (actual data), information gathering (information technology), forecasting (sophisticated statistical analysis), and risk management (arbitrage and hedging). On every “wager,” there are at least two sides to the transaction – a party that will ultimately win and one that will ultimately lose, both of which are intelligently looking at the market. So, when large uncertainty in the price exists, large uncertainty in the underlying ability of the market to meet supply and demand exists. If there were no uncertainty, no price volatility would exist nor would any profit potential for an energy marketer.

The real question is “what is driving the risk?” Prospectively, I believe the energy marketers believe the answers are: (1) world demand is starting to outstrip supply (see my blog “To Drill or Not to Drill, That is the Question”), (2) America consumes a disproportionate share of the oil resource, which drives world price, and (3) America will elect a president and congress that: (a) will withdraw from Iraq, leaving 60% of the worlds oil supply in the hands of our adversaries, (b) are not willing to tap potential sources of energy within our borders; and (c) will not commit to proven energy technologies but will replace them with less dense, passive technologies and conservation that will never meet our energy needs. In short, oil is in short supply and we do not want to do anything to increase that supply except talk. We need the oil and some else owns it. My bet is the price is going to go up.

So, the moral to the story is this. When the “speculator” watchdog starts barking, let’s shoot it. Or as John Preston, of Boston University, said “The nicest thing about not planning, is that failure comes as a complete surprise and is not preceded by a period of anxiety.”

Wednesday, June 25, 2008

Tuesday, June 24, 2008

To Drill or Not to Drill, That is the Question

The debate is raging. Should the United States drill or not drill within our borders for more oil? With prices at an all time high, the answer would appear to be simple. At the energy summit, ongoing in Jiddah, Saudi Arabia, Gordon Brown, the Prime Minister of the United Kingdom asserted that the issue is about too much demand and too little supply. The U.S. Energy Secretary, Samuel Bodman, said that insufficient oil production, not financial speculation, was driving soaring crude oil prices. However, this issue is as much about ideology as it is about technology and economics. In other words, one needs to look beyond the politicians and rhetoric to understand what is going on.

Production and Consumption. Fortunately, someone has provided us with a scientific (versus political) analysis of oil production over time. In 1998, Richard C. Duncan and Walter Youngquist forecast the world peak in oil production, “which will be a turning point in human history.” Their results are presented a series of three papers (referred to by them as Issues #1, #2, #3) entitled the World Petroleum Life Cycle , which was presented to the Petroleum Technology Transfer Council. Their methodology uses historic oil production data from the top 42 oil producing countries and statistical and heuristic modeling techniques. The 1998 paper (Issue #3), predicted that the peak in world energy production would occur in 2006. Prior analyses in 1996 (Issue #1) and 1997 (Issue #3) predicted a peak in world production in 2005 and 2007, respectively. The conclusions from this study are:

Production and Consumption. Fortunately, someone has provided us with a scientific (versus political) analysis of oil production over time. In 1998, Richard C. Duncan and Walter Youngquist forecast the world peak in oil production, “which will be a turning point in human history.” Their results are presented a series of three papers (referred to by them as Issues #1, #2, #3) entitled the World Petroleum Life Cycle , which was presented to the Petroleum Technology Transfer Council. Their methodology uses historic oil production data from the top 42 oil producing countries and statistical and heuristic modeling techniques. The 1998 paper (Issue #3), predicted that the peak in world energy production would occur in 2006. Prior analyses in 1996 (Issue #1) and 1997 (Issue #3) predicted a peak in world production in 2005 and 2007, respectively. The conclusions from this study are:

- Prediction 1: “Compounding world energy demands will be increasingly industrialized nations (particularly SE Asia, China, and India) wanting more energy per capita. China, Southeast Asia, and India now with some 60% of the world’s population are getting motorized wheels. If China used oil on a per capita basis as does the United States, China alone would be responsible for approximately 14 million barrels a day more than the present world’s entire world oil production.” [emphasis mine]

- Prediction 2: “A recent analysis by the Centre for Global Energy Studies (CGES), London, using a technique called logistic curve analysis, created one scenario in which even if non-OPEC countries discovered a further 500 billion barrels of oil, non-OPEC production would peak in about 2002 at 50 million barrels per day and decline more rapidly under conventional analysis. We are in full agreement with the CGES about the nearing of the non-OPEC peak.”

- Prediction 3: “Issues #1 through #3 of the Program predicted the world peak in the tight range of 2005 to 2007. However, Issue #3, Section 5, entitled ‘Can We Delay the World Oil Peak?” … concluded, ‘Yes, new production brought on stream well before the 2006 base-line peak can delay it, but only by few billion barrels of new production. However, even large increments of new production brought on after the peak is not likely to have any effect whatsoever on delaying the base-line world oil peak.” CGES’s review noted that oil production was once expected to peak in the 1980s, but has been successively pushed back into the first decade of the next century. However, CGES concludes that the peak may not be pushed back much further. “We are in full agreement with the CGES about the inertia of the world oil peak.”

- Prediction 4: Any oil strike in the former soviet socialist republics surrounding the Caspian Sea would be modest, contributing about 3% of the world’s oil supply. By contrast the Middle East holds about 60% of the world’s oil supply.

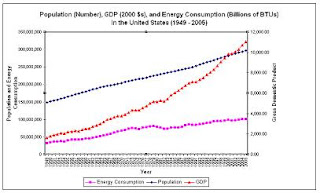

Remember these predictions were made in 1998. Based on the US government’s Energy Information Administration forecast (2007), historical consumption is shown in the graph to the left. In 2007, world consumption was 31Gb per year, which was what was projected.

Remember these predictions were made in 1998. Based on the US government’s Energy Information Administration forecast (2007), historical consumption is shown in the graph to the left. In 2007, world consumption was 31Gb per year, which was what was projected.

So, what does this analysis tell us:

· Based on 1998 estimates of technology capability, historical production rates, and forecasting techniques, we have reached peak world production, and the production market is now driven by OPEC countries.

· Production is in decline. It could have been mitigated but not reversed, by additional drilling as soon as possible.

· As production declines and demand from China and India increase, the law of supply and demand will drive oil commodity prices up. Prices will be driven higher by uncertainty of supply due to perceived and real threats to supply. Clearly, energy “speculation” (viz., trading) is driving up prices in the short-term; however, trading tends to discount future volatility in a market and therefore is a pre-cursor of a larger, looming problem.

Beyond the oil forecast, other historical facts are relevant to a decision to drill or not drill.

· Due to environmental protectionism, the United States currently sits on the world’s second largest coal supply (China is first). The United States coal supply is adjudged by some to contain three times the energy content of proven OPEC oil reserves, which comprise 60% of the world’s known oil reserves.

· United States Oil consumption is approximately 20 million barrels per day (7.3 billion per year) of which 50% is imported.

· The United States has known reserves of 86 billion barrels of oil offshore, of which 85% is off limits to drilling. This is equivalent to 12 years of total energy needs, or 24 years of imported needs, at current consumption rates.

· China is currently drilling off our coast, but we are not allowed to.

· Since 1998, the United States has developed new methods of exploring for oil, deep ocean drilling techniques, technology to recover sand tars, and methods for extracting oil from shale. This has opened up additional potential areas for energy recovery, including areas in the Rockies, Wyoming, Montana, and parts of the Dakotas. Although I have not researched this, my understanding from media reports is that exploration in these areas will require permission from the Federal government, much like the current situation in Anwar.

· During the 1960s and 1970s, nuclear power was commercialized in the United States, with the intention of producing low cost electrical energy, which would make electric residential heating and electric vehicles abundant and cheap. Where utilities have been allowed to commercially operate nuclear plants, in spite of their excessive regulatory cost, they are the lowest priced sources of electrical energy and are operated as base-loaded facilities.

· The United States is ranked 8th in the world in proven uranium reserves; Australia is ranked 1st and Canada is ranked 3rd.

· No new plants have been ordered in the United States since the late 1970s because of environmental activism. At that time, America was the world’s technology leader in the commercialization of nuclear power, which we ceded to the French and Germans. Today, France is 80% nuclear.

· Starting in the 1970s and until this year, the environmentalist have opposed nuclear power through political activism, fear, quack science, and distortion of the the facts. In the meantime, the existing 104 commercial nuclear units are reaching their end of useful life. Now, the high priests of environmentalism have declared nuclear to be green. As of this writing 14 applications have been made within the last year to the Nuclear Regulatory Commission for new plants. Unfortunately, burial of the waste at Yucca Mountain is mired in red tape and will not open until at least 2017, almost 40 years after discussion of this project started.

My conclusions are:

· In the near term we need to drill everywhere it is technically and economically feasible. Our economy and physical security rely on the internal combustion engine, and that technology will not be replaced for many years to come, no matter what alternative energy sources we develop. To address environmental concerns, we can let the Norwegians and the Danes do it. Apparently, like the French who mastered nuclear power and we could not for political reasons, the Scandinavians have safely and economically continued to explore, exploit, and place into production offshore oil drilling.

· Due to the ideology of environmentalism, we have missed the opportunity to bridge our economy from an oil based one to a nuclear one. We should license and build as many plants as we can. Because the average age of the nuclear thought leadership in this country is approximately 53 years and is retiring, we can ask the French and Chinese to head up this project.

· Offshore drilling restrictions should be relaxed. Funds from the lease of these properties should be put into technologies that show near term promise: nuclear, clean coal, fuel cells, and electric vehicles, especially battery technology. The energy density of solar and wind is not sufficient to provide the backbone of our energy infrastructure (see prior blogs). These technologies, with conservation, do have a place in the energy mix, but will never be more than 10 to 20% of our total energy supply.

· Put in place long term (10,20, 30 year) incentives to achieve energy independence goals.

· Learn from our mistakes. Environmental ideology and politics of fear prevented us from developing a critical technology, nuclear power. Since the 1970s, the French and Germans have been the technical leaders in this field and the principal suppliers of technology to others, including Pakistan, Iran, Iraq, and Libya. These nations not only control the oil but also now seek to develop nuclear weapons. They are not only a threat to our energy security, they are now a threat to our physical security.

Just like many other aspects of our society, energy policy in this country has been hijacked by those on the left. In fact, they are as bad if not worse than the energy traders, whose “speculation” simply quantifies in monetary terms what is otherwise bad policy and the inevitable consequences of ignoring the laws of supply and demand. By historically preventing the development of commercial nuclear power in this country, the environmentalist have effectively destroyed our “energy bridge” to the future. Now, we are in a declining oil-based market, where production has peaked, demand is increasing, and prices will certainly rise. Just like a “speculator,” the environmental left has created a perfect “straddle.” By now declaring nuclear environmentally safe, they have now given the “green” light to develop a technology supported by an aging infrastructure, an aging workforce, a mind numbing spider’s web of regulation, and nowhere to bury the waste. When this fails to address our energy needs in a timely manner, they will simply state it wasn’t their fault, and continue to push their agenda to develop passive energy technologies that do not have the energy density to meet the needs of a growing, technologically competitive society. For the environmental left, it is all about ideology and the science of the probable; it is not about common sense and the science of the possible.

Production and Consumption. Fortunately, someone has provided us with a scientific (versus political) analysis of oil production over time. In 1998, Richard C. Duncan and Walter Youngquist forecast the world peak in oil production, “which will be a turning point in human history.” Their results are presented a series of three papers (referred to by them as Issues #1, #2, #3) entitled the World Petroleum Life Cycle , which was presented to the Petroleum Technology Transfer Council. Their methodology uses historic oil production data from the top 42 oil producing countries and statistical and heuristic modeling techniques. The 1998 paper (Issue #3), predicted that the peak in world energy production would occur in 2006. Prior analyses in 1996 (Issue #1) and 1997 (Issue #3) predicted a peak in world production in 2005 and 2007, respectively. The conclusions from this study are:

Production and Consumption. Fortunately, someone has provided us with a scientific (versus political) analysis of oil production over time. In 1998, Richard C. Duncan and Walter Youngquist forecast the world peak in oil production, “which will be a turning point in human history.” Their results are presented a series of three papers (referred to by them as Issues #1, #2, #3) entitled the World Petroleum Life Cycle , which was presented to the Petroleum Technology Transfer Council. Their methodology uses historic oil production data from the top 42 oil producing countries and statistical and heuristic modeling techniques. The 1998 paper (Issue #3), predicted that the peak in world energy production would occur in 2006. Prior analyses in 1996 (Issue #1) and 1997 (Issue #3) predicted a peak in world production in 2005 and 2007, respectively. The conclusions from this study are:- Prediction 1: “Compounding world energy demands will be increasingly industrialized nations (particularly SE Asia, China, and India) wanting more energy per capita. China, Southeast Asia, and India now with some 60% of the world’s population are getting motorized wheels. If China used oil on a per capita basis as does the United States, China alone would be responsible for approximately 14 million barrels a day more than the present world’s entire world oil production.” [emphasis mine]

- Prediction 2: “A recent analysis by the Centre for Global Energy Studies (CGES), London, using a technique called logistic curve analysis, created one scenario in which even if non-OPEC countries discovered a further 500 billion barrels of oil, non-OPEC production would peak in about 2002 at 50 million barrels per day and decline more rapidly under conventional analysis. We are in full agreement with the CGES about the nearing of the non-OPEC peak.”

- Prediction 3: “Issues #1 through #3 of the Program predicted the world peak in the tight range of 2005 to 2007. However, Issue #3, Section 5, entitled ‘Can We Delay the World Oil Peak?” … concluded, ‘Yes, new production brought on stream well before the 2006 base-line peak can delay it, but only by few billion barrels of new production. However, even large increments of new production brought on after the peak is not likely to have any effect whatsoever on delaying the base-line world oil peak.” CGES’s review noted that oil production was once expected to peak in the 1980s, but has been successively pushed back into the first decade of the next century. However, CGES concludes that the peak may not be pushed back much further. “We are in full agreement with the CGES about the inertia of the world oil peak.”

- Prediction 4: Any oil strike in the former soviet socialist republics surrounding the Caspian Sea would be modest, contributing about 3% of the world’s oil supply. By contrast the Middle East holds about 60% of the world’s oil supply.

Remember these predictions were made in 1998. Based on the US government’s Energy Information Administration forecast (2007), historical consumption is shown in the graph to the left. In 2007, world consumption was 31Gb per year, which was what was projected.

Remember these predictions were made in 1998. Based on the US government’s Energy Information Administration forecast (2007), historical consumption is shown in the graph to the left. In 2007, world consumption was 31Gb per year, which was what was projected.So, what does this analysis tell us:

· Based on 1998 estimates of technology capability, historical production rates, and forecasting techniques, we have reached peak world production, and the production market is now driven by OPEC countries.

· Production is in decline. It could have been mitigated but not reversed, by additional drilling as soon as possible.

· As production declines and demand from China and India increase, the law of supply and demand will drive oil commodity prices up. Prices will be driven higher by uncertainty of supply due to perceived and real threats to supply. Clearly, energy “speculation” (viz., trading) is driving up prices in the short-term; however, trading tends to discount future volatility in a market and therefore is a pre-cursor of a larger, looming problem.

Beyond the oil forecast, other historical facts are relevant to a decision to drill or not drill.

· Due to environmental protectionism, the United States currently sits on the world’s second largest coal supply (China is first). The United States coal supply is adjudged by some to contain three times the energy content of proven OPEC oil reserves, which comprise 60% of the world’s known oil reserves.

· United States Oil consumption is approximately 20 million barrels per day (7.3 billion per year) of which 50% is imported.

· The United States has known reserves of 86 billion barrels of oil offshore, of which 85% is off limits to drilling. This is equivalent to 12 years of total energy needs, or 24 years of imported needs, at current consumption rates.

· China is currently drilling off our coast, but we are not allowed to.

· Since 1998, the United States has developed new methods of exploring for oil, deep ocean drilling techniques, technology to recover sand tars, and methods for extracting oil from shale. This has opened up additional potential areas for energy recovery, including areas in the Rockies, Wyoming, Montana, and parts of the Dakotas. Although I have not researched this, my understanding from media reports is that exploration in these areas will require permission from the Federal government, much like the current situation in Anwar.

· During the 1960s and 1970s, nuclear power was commercialized in the United States, with the intention of producing low cost electrical energy, which would make electric residential heating and electric vehicles abundant and cheap. Where utilities have been allowed to commercially operate nuclear plants, in spite of their excessive regulatory cost, they are the lowest priced sources of electrical energy and are operated as base-loaded facilities.

· The United States is ranked 8th in the world in proven uranium reserves; Australia is ranked 1st and Canada is ranked 3rd.

· No new plants have been ordered in the United States since the late 1970s because of environmental activism. At that time, America was the world’s technology leader in the commercialization of nuclear power, which we ceded to the French and Germans. Today, France is 80% nuclear.

· Starting in the 1970s and until this year, the environmentalist have opposed nuclear power through political activism, fear, quack science, and distortion of the the facts. In the meantime, the existing 104 commercial nuclear units are reaching their end of useful life. Now, the high priests of environmentalism have declared nuclear to be green. As of this writing 14 applications have been made within the last year to the Nuclear Regulatory Commission for new plants. Unfortunately, burial of the waste at Yucca Mountain is mired in red tape and will not open until at least 2017, almost 40 years after discussion of this project started.

My conclusions are:

· In the near term we need to drill everywhere it is technically and economically feasible. Our economy and physical security rely on the internal combustion engine, and that technology will not be replaced for many years to come, no matter what alternative energy sources we develop. To address environmental concerns, we can let the Norwegians and the Danes do it. Apparently, like the French who mastered nuclear power and we could not for political reasons, the Scandinavians have safely and economically continued to explore, exploit, and place into production offshore oil drilling.

· Due to the ideology of environmentalism, we have missed the opportunity to bridge our economy from an oil based one to a nuclear one. We should license and build as many plants as we can. Because the average age of the nuclear thought leadership in this country is approximately 53 years and is retiring, we can ask the French and Chinese to head up this project.

· Offshore drilling restrictions should be relaxed. Funds from the lease of these properties should be put into technologies that show near term promise: nuclear, clean coal, fuel cells, and electric vehicles, especially battery technology. The energy density of solar and wind is not sufficient to provide the backbone of our energy infrastructure (see prior blogs). These technologies, with conservation, do have a place in the energy mix, but will never be more than 10 to 20% of our total energy supply.

· Put in place long term (10,20, 30 year) incentives to achieve energy independence goals.

· Learn from our mistakes. Environmental ideology and politics of fear prevented us from developing a critical technology, nuclear power. Since the 1970s, the French and Germans have been the technical leaders in this field and the principal suppliers of technology to others, including Pakistan, Iran, Iraq, and Libya. These nations not only control the oil but also now seek to develop nuclear weapons. They are not only a threat to our energy security, they are now a threat to our physical security.

Just like many other aspects of our society, energy policy in this country has been hijacked by those on the left. In fact, they are as bad if not worse than the energy traders, whose “speculation” simply quantifies in monetary terms what is otherwise bad policy and the inevitable consequences of ignoring the laws of supply and demand. By historically preventing the development of commercial nuclear power in this country, the environmentalist have effectively destroyed our “energy bridge” to the future. Now, we are in a declining oil-based market, where production has peaked, demand is increasing, and prices will certainly rise. Just like a “speculator,” the environmental left has created a perfect “straddle.” By now declaring nuclear environmentally safe, they have now given the “green” light to develop a technology supported by an aging infrastructure, an aging workforce, a mind numbing spider’s web of regulation, and nowhere to bury the waste. When this fails to address our energy needs in a timely manner, they will simply state it wasn’t their fault, and continue to push their agenda to develop passive energy technologies that do not have the energy density to meet the needs of a growing, technologically competitive society. For the environmental left, it is all about ideology and the science of the probable; it is not about common sense and the science of the possible.

Thursday, June 19, 2008

A Cure for Energy Depression – More Sun?

By education and training, I am a nuclear engineer. By necessity, I am a business and information technology consultant. So it is, when you must feed a family of five, and the industry you believed would fuel the economy of the 21st century was killed in its nascence by environmental special interests, media disinformation, and government regulation. That is a subject for another posting; however, as my mother used to tell me, “Whatever does not kill you, will make you a stronger person.” And so it was with that attitude that I developed an interest in solar engineering, and almost took a job in that field in 1979. Maybe, I should have, but I came to the conclusion that solar would never be a serious solution to our basic energy needs, and I still believe that. It has its place in the energy mix, but you will never build a free, technology-based economy that can smelt steel and produce silicon chips from solar energy. I have two basic objections: (1) capital / operational costs and (2) energy density. A third reason for not supporting the technology, negative net energy generation (viz., more energy is required to manufacture the system than can be recovered over its life-cycle), has been overcome, at least in some system designs.

In prior postings, I have tried to provide you with the basic facts, so that you could follow my logic and conclusions. However, in this case, I have the facts straight from a proponent of solar energy: so, you don’t have to believe me, you can believe them.

The Montana Green Power (MGP) organization (http://www.montanagreenpower.com/) has produced a series of lessons to promote “green energy” in the schools. Lesson 8, “Are PV [Photovoltaic] Systems Cost-Effective?” This lesson has three objectives: (1) analyze the costs related to PV; (2) calculate the environmental cost savings of PV compared to fossil fuels; (3) investigate tax incentives or rebates [I guess they mean subsidies] that would make PV systems more affordable.

With respect to cost, the MGP lesson plan states:

“Today in Montana, a 2- to 4- kilowatt (kw) grid-intertied [viz., connected to the power grid] PV system will have an installed cost of between $9 and $16 per watt, with electricity produced over the life of the system costing 25 to 30 cents per kw-hour. In comparison, residential electricity purchased from the utility grid costs about 7 cents per kw-hour.

“We must also consider hidden environmental costs, called external costs. While the above information suggests that fossil fuels are much cheaper than renewable energy, consider these facts [emphasis mine]:

- Extracting fossil fuels causes environmental damage from the extraction equipment and from the pollution that is a by-product of burning those fuels.

- Fossil fuels are not free. They cost money to bring out of the ground. This means as fossil fuels run out, their price will increase.

- Fossil fuels give off gases whey they are burned. Most of these gases – sulfur oxides, nitrous oxides, and carbon dioxide, for example – may be [emphasis mine] causing a change in the global climate, sometimes, green house effect, climate change, or global warming.”

Let’s look at the stated financial benefit of solar, and put it in context. The installed cost is all cost required to design the system, purchase its components, purchase the site, install the components, and bring the system to the point of commercial operation. In the case of solar, this cost is $9 to $16 per watt. Using an average of $12.50 per watt, this is equivalent to $12,500 per kilowatt (kw). According to an article by Matthew Wald of the International Herald Tribune, “Price of new power plants rises sharply,” July 10, 2007, quoting a Duke Energy spokesman, he reported that it would cost $1.83 billion to build a new 800 Mw fossil plant, which represents a cost of $2,288 per kilowatt. The same article reported the cost of a nuclear plant to be in the same range: $2,000 to $3,000 per kw. In other words, a solar facility with the same capacity is more than five times as expensive to build as a modern fossil plant, with full environmental controls.

To check my facts, I went to a source where you would expect the source to be biased in favor of alternative energy sources: the California Energy Commission. They reported the capital cost of the following energy sources:

If you believe California, PVs are more cost competitive, but still twice the cost of fossil: just for the equipment.

If you believe California, PVs are more cost competitive, but still twice the cost of fossil: just for the equipment.

From an operating perspective, GMP reports that the ongoing cost of solar generation is 25 to 30 cents per kw-hour compared to 7 cents per kw-hour for fossil generation, or 4 times as expensive.

What about energy density? In a prior posting, I compared the energy density of fossil generation to the energy density of wind power. A 2,259 Mw fossil plant requires 800 acres (TVA’s Paradise Fossil Plant). Assuming that the fossil plant operates 70% of the time, then in one year it generates 17,315 Mw-hr/acre-year. To calculate the energy density of solar, the 1 – axis, tracking, flat-plate collector with a north-south axis data published by the National Renewable Energy Laboratory (http://www.nrel.gov/rredc/) was assumed, with the collector oriented relative to the horizon at latitude – 15 degrees. For Helena, Montana, the 30 year average of monthly, solar radiation, 1961 – 1990 is 6.3 kw-hr/meter square – day. Assuming 10.76 square feet per meter, 43,560 square feet per acre, and 365 days per year, solar radiation at the surface of the PV array is 9,309 Mw-hr/acre-yr. However, one must consider the conversion efficiency of the PV – its ability to take the solar radiation falling on it and convert it to electricity. According to Wikipedia, solar cell conversion efficiency for commercially available solar cells is 14% to 19%. Assuming 17%, then the energy supplied by a solar array in Helena, Montana, is 1,582 Mw-hr/acre-year. Therefore, fossil power is almost 11 times more efficient, from an energy density perspective, than solar power. In more practical terms, if you want to supply the energy requirements for 100,000 people, you can either build an 800 acre fossil plant or an 8,800 acre solar plant.

But GMP claims we should consider other external costs. But should we? The cost of mining coal, burning the coal, and meeting all the environmental standards is included in the cost of operations: 7 cents per kw-hr. It should not be included twice in the comparison, unless the objective is to kill the technology and one is willing to pay 4 times the price for solar. With respect to gas emissions, it is not scientifically proven that global warming is even occurring. If it is, the extent to which man’s activities contribute to it certainly has not been established. In fact, some studies suggest that volcanic activity and even cows contribute more to greenhouse gas than does man.

According to the American Coal Foundation, “Coal supplies in the United States are far more plentiful than domestic oil or natural gas; they account for 95 percent of the country's fossil fuel reserves and more than 60 percent of the world's fuel reserves. The United States has about 275 billion tons of recoverable coal, which could last us more than 250 years if we continue using coal at the same rate as we use it today. In addition, the United States has more than 25 percent of the world's estimated coal reserves.” Some estimate that America’s coal reserves, in terms of energy content, are more than three times that of the Saudian Arabia oil reserves.

In conclusion, when solar generation is compared to fossil generation, solar is five times more expensive to build, four times more expensive to operate, and requires eleven times as much land. The threat to the environment is at best unproven and at worst is overstated. Solar proponents are really using fear to advocate an ideological position that is not supported by the economics. That said, solar does have a place in the energy mix. In locations where there is high solar radiation for long periods of time and the location is not proximate to the existing electrical grid, solar may prove economic. Otherwise, let the free market rule: if an individual wants to make a commitment to the technology for personal reasons let him or her do so. No compelling basis exists to create a public policy that must be funded by the rest of us at a substantially greater cost.

The cure for energy depression is less sun.

In prior postings, I have tried to provide you with the basic facts, so that you could follow my logic and conclusions. However, in this case, I have the facts straight from a proponent of solar energy: so, you don’t have to believe me, you can believe them.

The Montana Green Power (MGP) organization (http://www.montanagreenpower.com/) has produced a series of lessons to promote “green energy” in the schools. Lesson 8, “Are PV [Photovoltaic] Systems Cost-Effective?” This lesson has three objectives: (1) analyze the costs related to PV; (2) calculate the environmental cost savings of PV compared to fossil fuels; (3) investigate tax incentives or rebates [I guess they mean subsidies] that would make PV systems more affordable.

With respect to cost, the MGP lesson plan states:

“Today in Montana, a 2- to 4- kilowatt (kw) grid-intertied [viz., connected to the power grid] PV system will have an installed cost of between $9 and $16 per watt, with electricity produced over the life of the system costing 25 to 30 cents per kw-hour. In comparison, residential electricity purchased from the utility grid costs about 7 cents per kw-hour.

“We must also consider hidden environmental costs, called external costs. While the above information suggests that fossil fuels are much cheaper than renewable energy, consider these facts [emphasis mine]:

- Extracting fossil fuels causes environmental damage from the extraction equipment and from the pollution that is a by-product of burning those fuels.

- Fossil fuels are not free. They cost money to bring out of the ground. This means as fossil fuels run out, their price will increase.

- Fossil fuels give off gases whey they are burned. Most of these gases – sulfur oxides, nitrous oxides, and carbon dioxide, for example – may be [emphasis mine] causing a change in the global climate, sometimes, green house effect, climate change, or global warming.”

Let’s look at the stated financial benefit of solar, and put it in context. The installed cost is all cost required to design the system, purchase its components, purchase the site, install the components, and bring the system to the point of commercial operation. In the case of solar, this cost is $9 to $16 per watt. Using an average of $12.50 per watt, this is equivalent to $12,500 per kilowatt (kw). According to an article by Matthew Wald of the International Herald Tribune, “Price of new power plants rises sharply,” July 10, 2007, quoting a Duke Energy spokesman, he reported that it would cost $1.83 billion to build a new 800 Mw fossil plant, which represents a cost of $2,288 per kilowatt. The same article reported the cost of a nuclear plant to be in the same range: $2,000 to $3,000 per kw. In other words, a solar facility with the same capacity is more than five times as expensive to build as a modern fossil plant, with full environmental controls.

To check my facts, I went to a source where you would expect the source to be biased in favor of alternative energy sources: the California Energy Commission. They reported the capital cost of the following energy sources:

If you believe California, PVs are more cost competitive, but still twice the cost of fossil: just for the equipment.

If you believe California, PVs are more cost competitive, but still twice the cost of fossil: just for the equipment.From an operating perspective, GMP reports that the ongoing cost of solar generation is 25 to 30 cents per kw-hour compared to 7 cents per kw-hour for fossil generation, or 4 times as expensive.

What about energy density? In a prior posting, I compared the energy density of fossil generation to the energy density of wind power. A 2,259 Mw fossil plant requires 800 acres (TVA’s Paradise Fossil Plant). Assuming that the fossil plant operates 70% of the time, then in one year it generates 17,315 Mw-hr/acre-year. To calculate the energy density of solar, the 1 – axis, tracking, flat-plate collector with a north-south axis data published by the National Renewable Energy Laboratory (http://www.nrel.gov/rredc/) was assumed, with the collector oriented relative to the horizon at latitude – 15 degrees. For Helena, Montana, the 30 year average of monthly, solar radiation, 1961 – 1990 is 6.3 kw-hr/meter square – day. Assuming 10.76 square feet per meter, 43,560 square feet per acre, and 365 days per year, solar radiation at the surface of the PV array is 9,309 Mw-hr/acre-yr. However, one must consider the conversion efficiency of the PV – its ability to take the solar radiation falling on it and convert it to electricity. According to Wikipedia, solar cell conversion efficiency for commercially available solar cells is 14% to 19%. Assuming 17%, then the energy supplied by a solar array in Helena, Montana, is 1,582 Mw-hr/acre-year. Therefore, fossil power is almost 11 times more efficient, from an energy density perspective, than solar power. In more practical terms, if you want to supply the energy requirements for 100,000 people, you can either build an 800 acre fossil plant or an 8,800 acre solar plant.

But GMP claims we should consider other external costs. But should we? The cost of mining coal, burning the coal, and meeting all the environmental standards is included in the cost of operations: 7 cents per kw-hr. It should not be included twice in the comparison, unless the objective is to kill the technology and one is willing to pay 4 times the price for solar. With respect to gas emissions, it is not scientifically proven that global warming is even occurring. If it is, the extent to which man’s activities contribute to it certainly has not been established. In fact, some studies suggest that volcanic activity and even cows contribute more to greenhouse gas than does man.

According to the American Coal Foundation, “Coal supplies in the United States are far more plentiful than domestic oil or natural gas; they account for 95 percent of the country's fossil fuel reserves and more than 60 percent of the world's fuel reserves. The United States has about 275 billion tons of recoverable coal, which could last us more than 250 years if we continue using coal at the same rate as we use it today. In addition, the United States has more than 25 percent of the world's estimated coal reserves.” Some estimate that America’s coal reserves, in terms of energy content, are more than three times that of the Saudian Arabia oil reserves.

In conclusion, when solar generation is compared to fossil generation, solar is five times more expensive to build, four times more expensive to operate, and requires eleven times as much land. The threat to the environment is at best unproven and at worst is overstated. Solar proponents are really using fear to advocate an ideological position that is not supported by the economics. That said, solar does have a place in the energy mix. In locations where there is high solar radiation for long periods of time and the location is not proximate to the existing electrical grid, solar may prove economic. Otherwise, let the free market rule: if an individual wants to make a commitment to the technology for personal reasons let him or her do so. No compelling basis exists to create a public policy that must be funded by the rest of us at a substantially greater cost.

The cure for energy depression is less sun.

True Colors – The Re-run

True Colors is a 1991 film written by Kevin Wade. The movie opens with Peter Burton (John Cusack) and his best friend Tim Garrity (James Spader) nervously awaiting the results of Peter’s congressional election and ends with Peter facing jail time and Tim, disillusioned and bitter. Tim, a top manager in the Department of Justice and who comes from an affluent family, is an idealistic person who wants to do what is right. Peter, who is embarrassed by his lower-class roots, is willing to use and manipulate anyone to get ahead. He plans a career in politics. In his blind ambition, Peter ultimately falls under the influence of organized crime, uses manipulation of his best friend and the truth, public corruption, and physical infirmity of his Senator father-in-law to gain support for his run for congress. Ultimately, Peter’s egotism and arrogance lead him to reveal his “true colors,” to Tim, who secretly captures Peter’s admission of guilt on surveillance tape and turns in his best friend.

Similarly, social progressives (“democrats”) ("Peter") have spent the past fifty years manipulating the American people ("Tim") and the truth to achieve their conversion of a capitalistic America to a socialistic America. They are starting to demonstrate their “true colors.” And we have it on surveillance tape (http://www.youtube.com/watch?v=PUaY3LhJ-IQ&feature=related) at least when it comes to their understanding of how America’s energy policy and markets should work.

The brouhaha started about two weeks ago, when Congresswoman Maxine Waters (D-CA) challenged the President of Shell Oil, John Hofmeister, to guarantee the American people that the prices they pay at the pump will go down if the oil companies are allowed to drill wherever they want off of US shores. Mr. Hofmeister responded, “ I can guarantee to the American people, because of the inaction of the United States Congress, ever increasing prices unless the demand comes down and five dollars will look like a very low price in the years to come if we are prohibited from finding new reserves and new opportunities to increase supplies.” To which, Ms. Waters responded, “ Guess what this liberal would be all about. This liberal will be all about socializing … ahhh, ahhh, (3 second pause), will be about (3 second pause), basically taking over and the government running all of your companies.” The word that this social progressive could not find in her vocabulary was “nationalize.” Not to be outdone and to clarify the record, on June 18, 2008, Maurice Hinchey (D-NY), explicitly stated the social progressives’ intent: “So if there is any seriousness about what some of our Republican colleagues are saying here in the House and elsewhere about improving the number of refineries, maybe they would be willing to have these refineries publicly owned by the people of the United States so that the people of the United States can determine how much of the product is refined and put out on the market. To me that sounds like a very good idea.” It sounded so good, that Malia Lazu, of Oil Change International, an Obama supporter, unequivocally stated that the oil companies should be taken over by the government.

So there it is. The democrats’ strategy is to nationalize … or euphemistically, socialize, if you listen to the eloquence of Maxine Waters … a major segment of the United States economy because, at the core of it, they do not understand basic economic theory. I guess when all you have in your tool chest is a hammer, all problems look like a nail. Hopefully the government will be able to “nationalize” the oil industry better than they have regulated the commercial nuclear electric industry, which they managed to kill. After almost 30 years of discussion on the burial of nuclear waste at Yucca Mountain, we are still 8 to 11 years away from a final decision. In the meantime, France has no problem with nuclear waste: they have been vitrifying it for 20 years, and now nuclear power represents 80% of their electricity production.

Unfortunately, no rational, prospective decision will be forthcoming from the “democrats.” Generally, they do better when a lot of polling data and prior historical data exist, which they can second-guess. Hindsight is always 20-20. However, when pushed to make a critical decision, rest assured they will show their “true colors.”

Similarly, social progressives (“democrats”) ("Peter") have spent the past fifty years manipulating the American people ("Tim") and the truth to achieve their conversion of a capitalistic America to a socialistic America. They are starting to demonstrate their “true colors.” And we have it on surveillance tape (http://www.youtube.com/watch?v=PUaY3LhJ-IQ&feature=related) at least when it comes to their understanding of how America’s energy policy and markets should work.

The brouhaha started about two weeks ago, when Congresswoman Maxine Waters (D-CA) challenged the President of Shell Oil, John Hofmeister, to guarantee the American people that the prices they pay at the pump will go down if the oil companies are allowed to drill wherever they want off of US shores. Mr. Hofmeister responded, “ I can guarantee to the American people, because of the inaction of the United States Congress, ever increasing prices unless the demand comes down and five dollars will look like a very low price in the years to come if we are prohibited from finding new reserves and new opportunities to increase supplies.” To which, Ms. Waters responded, “ Guess what this liberal would be all about. This liberal will be all about socializing … ahhh, ahhh, (3 second pause), will be about (3 second pause), basically taking over and the government running all of your companies.” The word that this social progressive could not find in her vocabulary was “nationalize.” Not to be outdone and to clarify the record, on June 18, 2008, Maurice Hinchey (D-NY), explicitly stated the social progressives’ intent: “So if there is any seriousness about what some of our Republican colleagues are saying here in the House and elsewhere about improving the number of refineries, maybe they would be willing to have these refineries publicly owned by the people of the United States so that the people of the United States can determine how much of the product is refined and put out on the market. To me that sounds like a very good idea.” It sounded so good, that Malia Lazu, of Oil Change International, an Obama supporter, unequivocally stated that the oil companies should be taken over by the government.

So there it is. The democrats’ strategy is to nationalize … or euphemistically, socialize, if you listen to the eloquence of Maxine Waters … a major segment of the United States economy because, at the core of it, they do not understand basic economic theory. I guess when all you have in your tool chest is a hammer, all problems look like a nail. Hopefully the government will be able to “nationalize” the oil industry better than they have regulated the commercial nuclear electric industry, which they managed to kill. After almost 30 years of discussion on the burial of nuclear waste at Yucca Mountain, we are still 8 to 11 years away from a final decision. In the meantime, France has no problem with nuclear waste: they have been vitrifying it for 20 years, and now nuclear power represents 80% of their electricity production.

Unfortunately, no rational, prospective decision will be forthcoming from the “democrats.” Generally, they do better when a lot of polling data and prior historical data exist, which they can second-guess. Hindsight is always 20-20. However, when pushed to make a critical decision, rest assured they will show their “true colors.”

Tuesday, June 17, 2008

A New Idea – Tax the “Poor!”

A number of years ago, the manager of energy trading at a major electric utility taught me a lesson he called “thinking through the bottom of the box (TTBB).” We have all heard of “thinking outside the box (TOB),” but TTBB offered a whole new way of thinking about the world around us and creating possible solutions to the problems we face.

I was intrigued, so I asked him how it worked. He illustrated TTBB with a story. “Suppose,” he said, “that you and I were contenders for the world heavyweight boxing title. To improve my chances of winning, I hired a world-renowned trainer and asked him for his advice. He stated that, after some reflection, you and I were the same weight, had the same reach, and had the same record. Despondent, I asked how I could possibly beat you. He quickly responded, "Hit him below the belt." Appalled, I retorted, "But that is illegal!" To which he responded, "Contact is illegal. Fake a punch to the groin with your left, he will try to protect himself with his right, which will allow you to use your left hook, which is your best punch."

So what does this have to do with my idea of taxing the poor? Well, we all know that traditional wisdom would say this proposition is ridiculous on its face: the poor need money. They do not have money. However, if you apply TTBB and relax all constraints, evaluate all possibilities, put together a plausible alternative, and then re-evaluate the constraints, you can devise creative, plausible alternatives where none initially appear to exist. In this case, what the poor have is time, not money.

So the thinking goes like this. The revenue to the federal treasury is estimated to be $2.7 trillion dollars per year in 2008. In 2006, the population was estimated to be almost 300 million, with approximately 75% over the age of 18, or about 225 million. Approximately 37 million of these are over 65. Approximately 50% of all taxpayers’ pay 100% of all tax, which means 50% of the people pay nothing but receive their pro rata share of the benefits, at a minimum. So, if one assumes all persons over the age of 18 are beneficiaries of this wonderful system, then the “benefit” [50% of $2.7 trillion] to the 50% not paying taxes [50% of 188 million (225 million over age 18 less the 37 million over age 65], represents $14,361 per person not paying tax. Imputing to these individuals a median income of $38,387 [2006, Heritage Foundation, which really represents a "raise" for their time, because they are in the lower 50% of the income pool] and a work year of 1,928 hours [2,080 hours per year, less 2 weeks vacation, and 9 holidays), this equates to 721 hours per year to pay for their benefits.

So, here is my proposal. Require those over the age of 18 and less than 65, who pay no taxes whatsoever, to contribute only 416 hours per year (one day per week, not the 721 they “owe”) to the rest of us, who are paying the taxes. This time can be “donated” in a variety of ways. Several come to mind immediately: participating in rehab; working on their GED; serving in the military reserves; picking up trash. I am open to any activity which has the following features: (1) the work must contribute to the betterment of the individual, the community, and the country (responsibility); (2) the work must be performed EVERY week at a standard time (discipline); (2) the work must be supervised (accountability); (3) the work must be performed until either mutually agreed goals are achieved or the individual becomes a tax payer (results). Maybe, just maybe, some of these folks will be so successful, they will end up owning their own business and experience first hand the “privilege” of making payroll, week in and week out, and reducing the tax burden on the rest of us.

I was intrigued, so I asked him how it worked. He illustrated TTBB with a story. “Suppose,” he said, “that you and I were contenders for the world heavyweight boxing title. To improve my chances of winning, I hired a world-renowned trainer and asked him for his advice. He stated that, after some reflection, you and I were the same weight, had the same reach, and had the same record. Despondent, I asked how I could possibly beat you. He quickly responded, "Hit him below the belt." Appalled, I retorted, "But that is illegal!" To which he responded, "Contact is illegal. Fake a punch to the groin with your left, he will try to protect himself with his right, which will allow you to use your left hook, which is your best punch."

So what does this have to do with my idea of taxing the poor? Well, we all know that traditional wisdom would say this proposition is ridiculous on its face: the poor need money. They do not have money. However, if you apply TTBB and relax all constraints, evaluate all possibilities, put together a plausible alternative, and then re-evaluate the constraints, you can devise creative, plausible alternatives where none initially appear to exist. In this case, what the poor have is time, not money.

So the thinking goes like this. The revenue to the federal treasury is estimated to be $2.7 trillion dollars per year in 2008. In 2006, the population was estimated to be almost 300 million, with approximately 75% over the age of 18, or about 225 million. Approximately 37 million of these are over 65. Approximately 50% of all taxpayers’ pay 100% of all tax, which means 50% of the people pay nothing but receive their pro rata share of the benefits, at a minimum. So, if one assumes all persons over the age of 18 are beneficiaries of this wonderful system, then the “benefit” [50% of $2.7 trillion] to the 50% not paying taxes [50% of 188 million (225 million over age 18 less the 37 million over age 65], represents $14,361 per person not paying tax. Imputing to these individuals a median income of $38,387 [2006, Heritage Foundation, which really represents a "raise" for their time, because they are in the lower 50% of the income pool] and a work year of 1,928 hours [2,080 hours per year, less 2 weeks vacation, and 9 holidays), this equates to 721 hours per year to pay for their benefits.

So, here is my proposal. Require those over the age of 18 and less than 65, who pay no taxes whatsoever, to contribute only 416 hours per year (one day per week, not the 721 they “owe”) to the rest of us, who are paying the taxes. This time can be “donated” in a variety of ways. Several come to mind immediately: participating in rehab; working on their GED; serving in the military reserves; picking up trash. I am open to any activity which has the following features: (1) the work must contribute to the betterment of the individual, the community, and the country (responsibility); (2) the work must be performed EVERY week at a standard time (discipline); (2) the work must be supervised (accountability); (3) the work must be performed until either mutually agreed goals are achieved or the individual becomes a tax payer (results). Maybe, just maybe, some of these folks will be so successful, they will end up owning their own business and experience first hand the “privilege” of making payroll, week in and week out, and reducing the tax burden on the rest of us.

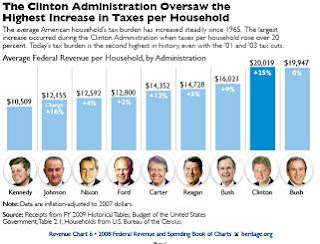

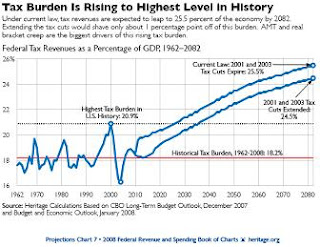

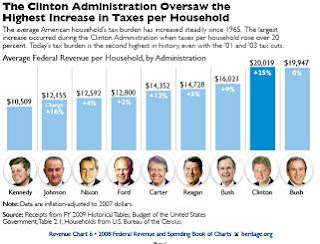

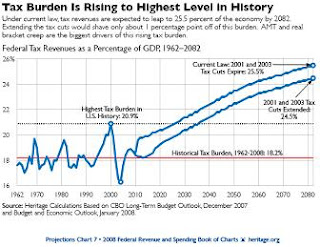

A Recipe for Economic Disaster: Coming to Your Home Soon

In my blog on June 12, 2008 (“Taxing the Rich Really is Taxing All of Us”), I summarized the economic consequences of Barack Obama’s proposed tax policy. In it, I described at a high level his proposals for paying for at least $1.4 trillion in new federal spending over the next five years. This is the largest proposed tax increase since Bill Clinton’s 1993 tax increase of $240.6B over five years, which Sen. Daniel Patrick Moynihan (D-NY) called the “largest tax increase in the history of public finance in the United States or anywhere else in the world.” But Obama's proposal would increase spending $300 B in a single year. I thought it might be instructive to compare and contrast his tax proposals to those of his rival Senator McCain, and put this all into some quantitative perspective.

Individual Tax Increases. With Bush’s tax cuts scheduled to expire in 2011, Congress will be under pressure to pass legislation to extend or replace them. Obama opposes continuance of these tax cuts and, with a social progressive (“democratic”) majority in the house and senate, will most likely eliminate them. This action will increase income taxes on “hard working Americans” in the top two tax brackets, raising the marginal rate on ordinary income from 35% to 39.6%, according to William Ahern, spokesman for the Tax Foundation, a nonpartisan research group. Mr. Ahern also asserts, as does Senators Wayne Allard (R-CO) [source: Amendment 4246 to the senate budget bill (3/14/2008)] and

Individual Tax Increases. With Bush’s tax cuts scheduled to expire in 2011, Congress will be under pressure to pass legislation to extend or replace them. Obama opposes continuance of these tax cuts and, with a social progressive (“democratic”) majority in the house and senate, will most likely eliminate them. This action will increase income taxes on “hard working Americans” in the top two tax brackets, raising the marginal rate on ordinary income from 35% to 39.6%, according to William Ahern, spokesman for the Tax Foundation, a nonpartisan research group. Mr. Ahern also asserts, as does Senators Wayne Allard (R-CO) [source: Amendment 4246 to the senate budget bill (3/14/2008)] and  Richard Burr (R-NC) that the social progressives have proposed more spending than could be paid for by the tax increases they have discussed. According to Ahern, “they are likely to seek even higher taxes.” [source: The tax Foundation, “Summary of the Presidential Candidates’ Tax Plans”]. In contrast, Sen. McCain not only intends to make the tax cuts permanent, he has stated that he would reduce the corporate tax rate, now 35%, to 25% in a bid to stimulate the economy.

Richard Burr (R-NC) that the social progressives have proposed more spending than could be paid for by the tax increases they have discussed. According to Ahern, “they are likely to seek even higher taxes.” [source: The tax Foundation, “Summary of the Presidential Candidates’ Tax Plans”]. In contrast, Sen. McCain not only intends to make the tax cuts permanent, he has stated that he would reduce the corporate tax rate, now 35%, to 25% in a bid to stimulate the economy.

AMT. The Alternative Minimum Tax (AMT) "was created in 1969 to target 21 -- yes, 21 -- millionaires who had managed to avoid paying any taxes at all. According to the Wall Street Journal, April 14, 2007) more than three million taxpayers were affected by the Alternative Minimum Tax on their 2006 income. The Wall Street Journal estimated that the number could rise to 23 million in 2007. In fact, it did not, only because Congress passed a so-called "patch" to prevent it. This year, the AMT “adjustment” to index the tax to inflation will potentially cost taxpayers $63 billion. McCain has stated he would phase out the AMT (www.JohnMcCain.com). Obama voted not to repeal it but has yet to provide more detailed plans. Obama has criticized McCain for not specifying how he would pay for the revenue reduction associated with the loss of the AMT; however, McCain has responded that he would entertain a fair tax or flat tax that have as one of their objectives the elimination of the IRS as we know it. The IRS employs 91,000 employees with an annual budget of $11.4 billion. The Cato institute estimates that business and individuals spend 6.4 billion hours per year in tax compliance, which the Tax Foundation estimated to be worth $265.1 billion in 2005. Between these two expenses, McCain should be able to cut $65 billion and “re-purpose” (a government euphemism for spend) the rest. Tacitly assumed in Obama’s argument is the assumption that every penny needs to be replaced, as though it is well spent. In 1993, the General Accounting Office (GAO) audited the IRS for the first time in its history and found widespread evidence of financial malfeasance and gross negligence, including the fact that the agency was unable to account for 64% of its congressional appropriation.

AMT. The Alternative Minimum Tax (AMT) "was created in 1969 to target 21 -- yes, 21 -- millionaires who had managed to avoid paying any taxes at all. According to the Wall Street Journal, April 14, 2007) more than three million taxpayers were affected by the Alternative Minimum Tax on their 2006 income. The Wall Street Journal estimated that the number could rise to 23 million in 2007. In fact, it did not, only because Congress passed a so-called "patch" to prevent it. This year, the AMT “adjustment” to index the tax to inflation will potentially cost taxpayers $63 billion. McCain has stated he would phase out the AMT (www.JohnMcCain.com). Obama voted not to repeal it but has yet to provide more detailed plans. Obama has criticized McCain for not specifying how he would pay for the revenue reduction associated with the loss of the AMT; however, McCain has responded that he would entertain a fair tax or flat tax that have as one of their objectives the elimination of the IRS as we know it. The IRS employs 91,000 employees with an annual budget of $11.4 billion. The Cato institute estimates that business and individuals spend 6.4 billion hours per year in tax compliance, which the Tax Foundation estimated to be worth $265.1 billion in 2005. Between these two expenses, McCain should be able to cut $65 billion and “re-purpose” (a government euphemism for spend) the rest. Tacitly assumed in Obama’s argument is the assumption that every penny needs to be replaced, as though it is well spent. In 1993, the General Accounting Office (GAO) audited the IRS for the first time in its history and found widespread evidence of financial malfeasance and gross negligence, including the fact that the agency was unable to account for 64% of its congressional appropriation.

Corporate Taxation. Obama is in favor of raising the current 15% tax rate on long-term capital gains and dividends to 28%. Raising the tax rate would lower after-tax returns on equities, just as baby-boomers enter retirement, further impacting their retirement incomes, as well as throwing a wet blanket on the economy, as it is trying to avoid recession. Obama also advocates treating dividends as ordinary income. McCain has pledged to keep current rates on dividends and capital gains at their present level. “When rates are low, companies pay out more retained earnings and dividends, and dividends spur economic growth as investors plow the money back into other companies,” says Raj Chetty, professor of economics at UC-Berkley, who has studied how corporations respond to a favorable dividend rate.

Corporate Taxation. Obama is in favor of raising the current 15% tax rate on long-term capital gains and dividends to 28%. Raising the tax rate would lower after-tax returns on equities, just as baby-boomers enter retirement, further impacting their retirement incomes, as well as throwing a wet blanket on the economy, as it is trying to avoid recession. Obama also advocates treating dividends as ordinary income. McCain has pledged to keep current rates on dividends and capital gains at their present level. “When rates are low, companies pay out more retained earnings and dividends, and dividends spur economic growth as investors plow the money back into other companies,” says Raj Chetty, professor of economics at UC-Berkley, who has studied how corporations respond to a favorable dividend rate.

Social Security, Medicare, Medicaid. Neither candidate has proposed definitive approaches to solving the Medicare and Social Security issues facing the country. If healthcare costs continue to outpace the growth in GDP, do not expect the estate tax, which is scheduled to be reinstituted and jump from 0% in 2010 to 55% in 2011 for estates over $1M, to close this gap. McCain has suggested he would support higher exemption levels and lower tax rates: a 15% estate tax with a $10 million exemption for couples. Obama has no plan other than to let the tax expire. According to Sandra Day O’Connor (former Supreme Court Justice) and James R. Jones (former Ambassador to Mexico), in their OpEd piece “What we owe our young,” Virginian Pilot, June 17, 2008, “Even if every dollar of wealth of every millionaire in the United States were magically diverted to pay these costs [Social Security, Medicare, and Medicaid bill that are coming due over the next several decades], 80 percent of the unfunded liabilities forecast for these three programs would remain on the books.” [Emphasis mine]

Social Security, Medicare, Medicaid. Neither candidate has proposed definitive approaches to solving the Medicare and Social Security issues facing the country. If healthcare costs continue to outpace the growth in GDP, do not expect the estate tax, which is scheduled to be reinstituted and jump from 0% in 2010 to 55% in 2011 for estates over $1M, to close this gap. McCain has suggested he would support higher exemption levels and lower tax rates: a 15% estate tax with a $10 million exemption for couples. Obama has no plan other than to let the tax expire. According to Sandra Day O’Connor (former Supreme Court Justice) and James R. Jones (former Ambassador to Mexico), in their OpEd piece “What we owe our young,” Virginian Pilot, June 17, 2008, “Even if every dollar of wealth of every millionaire in the United States were magically diverted to pay these costs [Social Security, Medicare, and Medicaid bill that are coming due over the next several decades], 80 percent of the unfunded liabilities forecast for these three programs would remain on the books.” [Emphasis mine]

America’s problems are grave. However, proposing new spending and raising tax rates to cover them is only a band-aid fix: they must be seriously addressed. Taking money out of the hands of “hard working” Americans and putting them in the hands of politicians has resulted in a 334% increase in Federal spending since 1965 (from $628 billion to $2.7 trillion in 2007 inflation adjusted dollars), while the median income of the average American has risen 35% ($28,346 to $38,386). Over this period, mandatory spending on entitlement programs has grown from 26.9% of the budget to 52.9% of the budget. When interest is considered (8.3%), only 38.8% of the budget is discretionary (within the control of the President). A better solution is to take the decision making out of the hands of a do-nothing, socially progressive government and let the average “hard working” American decide for himself or herself how to spend his or her income. Clearly, Obama’s proposals would make this much, much more difficult.

For additional information on this subject, see the Heritage Foundation, 2008 Federal Revenues and Spending Book of Charts, at:

http://www.heritage.org/research/features/budgetchartbook/index.html

Individual Tax Increases. With Bush’s tax cuts scheduled to expire in 2011, Congress will be under pressure to pass legislation to extend or replace them. Obama opposes continuance of these tax cuts and, with a social progressive (“democratic”) majority in the house and senate, will most likely eliminate them. This action will increase income taxes on “hard working Americans” in the top two tax brackets, raising the marginal rate on ordinary income from 35% to 39.6%, according to William Ahern, spokesman for the Tax Foundation, a nonpartisan research group. Mr. Ahern also asserts, as does Senators Wayne Allard (R-CO) [source: Amendment 4246 to the senate budget bill (3/14/2008)] and

Individual Tax Increases. With Bush’s tax cuts scheduled to expire in 2011, Congress will be under pressure to pass legislation to extend or replace them. Obama opposes continuance of these tax cuts and, with a social progressive (“democratic”) majority in the house and senate, will most likely eliminate them. This action will increase income taxes on “hard working Americans” in the top two tax brackets, raising the marginal rate on ordinary income from 35% to 39.6%, according to William Ahern, spokesman for the Tax Foundation, a nonpartisan research group. Mr. Ahern also asserts, as does Senators Wayne Allard (R-CO) [source: Amendment 4246 to the senate budget bill (3/14/2008)] and  Richard Burr (R-NC) that the social progressives have proposed more spending than could be paid for by the tax increases they have discussed. According to Ahern, “they are likely to seek even higher taxes.” [source: The tax Foundation, “Summary of the Presidential Candidates’ Tax Plans”]. In contrast, Sen. McCain not only intends to make the tax cuts permanent, he has stated that he would reduce the corporate tax rate, now 35%, to 25% in a bid to stimulate the economy.

Richard Burr (R-NC) that the social progressives have proposed more spending than could be paid for by the tax increases they have discussed. According to Ahern, “they are likely to seek even higher taxes.” [source: The tax Foundation, “Summary of the Presidential Candidates’ Tax Plans”]. In contrast, Sen. McCain not only intends to make the tax cuts permanent, he has stated that he would reduce the corporate tax rate, now 35%, to 25% in a bid to stimulate the economy. AMT. The Alternative Minimum Tax (AMT) "was created in 1969 to target 21 -- yes, 21 -- millionaires who had managed to avoid paying any taxes at all. According to the Wall Street Journal, April 14, 2007) more than three million taxpayers were affected by the Alternative Minimum Tax on their 2006 income. The Wall Street Journal estimated that the number could rise to 23 million in 2007. In fact, it did not, only because Congress passed a so-called "patch" to prevent it. This year, the AMT “adjustment” to index the tax to inflation will potentially cost taxpayers $63 billion. McCain has stated he would phase out the AMT (www.JohnMcCain.com). Obama voted not to repeal it but has yet to provide more detailed plans. Obama has criticized McCain for not specifying how he would pay for the revenue reduction associated with the loss of the AMT; however, McCain has responded that he would entertain a fair tax or flat tax that have as one of their objectives the elimination of the IRS as we know it. The IRS employs 91,000 employees with an annual budget of $11.4 billion. The Cato institute estimates that business and individuals spend 6.4 billion hours per year in tax compliance, which the Tax Foundation estimated to be worth $265.1 billion in 2005. Between these two expenses, McCain should be able to cut $65 billion and “re-purpose” (a government euphemism for spend) the rest. Tacitly assumed in Obama’s argument is the assumption that every penny needs to be replaced, as though it is well spent. In 1993, the General Accounting Office (GAO) audited the IRS for the first time in its history and found widespread evidence of financial malfeasance and gross negligence, including the fact that the agency was unable to account for 64% of its congressional appropriation.

AMT. The Alternative Minimum Tax (AMT) "was created in 1969 to target 21 -- yes, 21 -- millionaires who had managed to avoid paying any taxes at all. According to the Wall Street Journal, April 14, 2007) more than three million taxpayers were affected by the Alternative Minimum Tax on their 2006 income. The Wall Street Journal estimated that the number could rise to 23 million in 2007. In fact, it did not, only because Congress passed a so-called "patch" to prevent it. This year, the AMT “adjustment” to index the tax to inflation will potentially cost taxpayers $63 billion. McCain has stated he would phase out the AMT (www.JohnMcCain.com). Obama voted not to repeal it but has yet to provide more detailed plans. Obama has criticized McCain for not specifying how he would pay for the revenue reduction associated with the loss of the AMT; however, McCain has responded that he would entertain a fair tax or flat tax that have as one of their objectives the elimination of the IRS as we know it. The IRS employs 91,000 employees with an annual budget of $11.4 billion. The Cato institute estimates that business and individuals spend 6.4 billion hours per year in tax compliance, which the Tax Foundation estimated to be worth $265.1 billion in 2005. Between these two expenses, McCain should be able to cut $65 billion and “re-purpose” (a government euphemism for spend) the rest. Tacitly assumed in Obama’s argument is the assumption that every penny needs to be replaced, as though it is well spent. In 1993, the General Accounting Office (GAO) audited the IRS for the first time in its history and found widespread evidence of financial malfeasance and gross negligence, including the fact that the agency was unable to account for 64% of its congressional appropriation. Corporate Taxation. Obama is in favor of raising the current 15% tax rate on long-term capital gains and dividends to 28%. Raising the tax rate would lower after-tax returns on equities, just as baby-boomers enter retirement, further impacting their retirement incomes, as well as throwing a wet blanket on the economy, as it is trying to avoid recession. Obama also advocates treating dividends as ordinary income. McCain has pledged to keep current rates on dividends and capital gains at their present level. “When rates are low, companies pay out more retained earnings and dividends, and dividends spur economic growth as investors plow the money back into other companies,” says Raj Chetty, professor of economics at UC-Berkley, who has studied how corporations respond to a favorable dividend rate.

Corporate Taxation. Obama is in favor of raising the current 15% tax rate on long-term capital gains and dividends to 28%. Raising the tax rate would lower after-tax returns on equities, just as baby-boomers enter retirement, further impacting their retirement incomes, as well as throwing a wet blanket on the economy, as it is trying to avoid recession. Obama also advocates treating dividends as ordinary income. McCain has pledged to keep current rates on dividends and capital gains at their present level. “When rates are low, companies pay out more retained earnings and dividends, and dividends spur economic growth as investors plow the money back into other companies,” says Raj Chetty, professor of economics at UC-Berkley, who has studied how corporations respond to a favorable dividend rate. Social Security, Medicare, Medicaid. Neither candidate has proposed definitive approaches to solving the Medicare and Social Security issues facing the country. If healthcare costs continue to outpace the growth in GDP, do not expect the estate tax, which is scheduled to be reinstituted and jump from 0% in 2010 to 55% in 2011 for estates over $1M, to close this gap. McCain has suggested he would support higher exemption levels and lower tax rates: a 15% estate tax with a $10 million exemption for couples. Obama has no plan other than to let the tax expire. According to Sandra Day O’Connor (former Supreme Court Justice) and James R. Jones (former Ambassador to Mexico), in their OpEd piece “What we owe our young,” Virginian Pilot, June 17, 2008, “Even if every dollar of wealth of every millionaire in the United States were magically diverted to pay these costs [Social Security, Medicare, and Medicaid bill that are coming due over the next several decades], 80 percent of the unfunded liabilities forecast for these three programs would remain on the books.” [Emphasis mine]