Individual Tax Increases. With Bush’s tax cuts scheduled to expire in 2011, Congress will be under pressure to pass legislation to extend or replace them. Obama opposes continuance of these tax cuts and, with a social progressive (“democratic”) majority in the house and senate, will most likely eliminate them. This action will increase income taxes on “hard working Americans” in the top two tax brackets, raising the marginal rate on ordinary income from 35% to 39.6%, according to William Ahern, spokesman for the Tax Foundation, a nonpartisan research group. Mr. Ahern also asserts, as does Senators Wayne Allard (R-CO) [source: Amendment 4246 to the senate budget bill (3/14/2008)] and

Individual Tax Increases. With Bush’s tax cuts scheduled to expire in 2011, Congress will be under pressure to pass legislation to extend or replace them. Obama opposes continuance of these tax cuts and, with a social progressive (“democratic”) majority in the house and senate, will most likely eliminate them. This action will increase income taxes on “hard working Americans” in the top two tax brackets, raising the marginal rate on ordinary income from 35% to 39.6%, according to William Ahern, spokesman for the Tax Foundation, a nonpartisan research group. Mr. Ahern also asserts, as does Senators Wayne Allard (R-CO) [source: Amendment 4246 to the senate budget bill (3/14/2008)] and  Richard Burr (R-NC) that the social progressives have proposed more spending than could be paid for by the tax increases they have discussed. According to Ahern, “they are likely to seek even higher taxes.” [source: The tax Foundation, “Summary of the Presidential Candidates’ Tax Plans”]. In contrast, Sen. McCain not only intends to make the tax cuts permanent, he has stated that he would reduce the corporate tax rate, now 35%, to 25% in a bid to stimulate the economy.

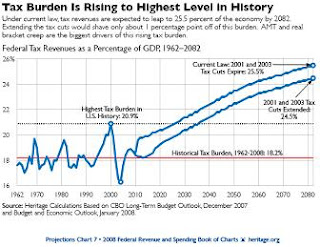

Richard Burr (R-NC) that the social progressives have proposed more spending than could be paid for by the tax increases they have discussed. According to Ahern, “they are likely to seek even higher taxes.” [source: The tax Foundation, “Summary of the Presidential Candidates’ Tax Plans”]. In contrast, Sen. McCain not only intends to make the tax cuts permanent, he has stated that he would reduce the corporate tax rate, now 35%, to 25% in a bid to stimulate the economy. AMT. The Alternative Minimum Tax (AMT) "was created in 1969 to target 21 -- yes, 21 -- millionaires who had managed to avoid paying any taxes at all. According to the Wall Street Journal, April 14, 2007) more than three million taxpayers were affected by the Alternative Minimum Tax on their 2006 income. The Wall Street Journal estimated that the number could rise to 23 million in 2007. In fact, it did not, only because Congress passed a so-called "patch" to prevent it. This year, the AMT “adjustment” to index the tax to inflation will potentially cost taxpayers $63 billion. McCain has stated he would phase out the AMT (www.JohnMcCain.com). Obama voted not to repeal it but has yet to provide more detailed plans. Obama has criticized McCain for not specifying how he would pay for the revenue reduction associated with the loss of the AMT; however, McCain has responded that he would entertain a fair tax or flat tax that have as one of their objectives the elimination of the IRS as we know it. The IRS employs 91,000 employees with an annual budget of $11.4 billion. The Cato institute estimates that business and individuals spend 6.4 billion hours per year in tax compliance, which the Tax Foundation estimated to be worth $265.1 billion in 2005. Between these two expenses, McCain should be able to cut $65 billion and “re-purpose” (a government euphemism for spend) the rest. Tacitly assumed in Obama’s argument is the assumption that every penny needs to be replaced, as though it is well spent. In 1993, the General Accounting Office (GAO) audited the IRS for the first time in its history and found widespread evidence of financial malfeasance and gross negligence, including the fact that the agency was unable to account for 64% of its congressional appropriation.

AMT. The Alternative Minimum Tax (AMT) "was created in 1969 to target 21 -- yes, 21 -- millionaires who had managed to avoid paying any taxes at all. According to the Wall Street Journal, April 14, 2007) more than three million taxpayers were affected by the Alternative Minimum Tax on their 2006 income. The Wall Street Journal estimated that the number could rise to 23 million in 2007. In fact, it did not, only because Congress passed a so-called "patch" to prevent it. This year, the AMT “adjustment” to index the tax to inflation will potentially cost taxpayers $63 billion. McCain has stated he would phase out the AMT (www.JohnMcCain.com). Obama voted not to repeal it but has yet to provide more detailed plans. Obama has criticized McCain for not specifying how he would pay for the revenue reduction associated with the loss of the AMT; however, McCain has responded that he would entertain a fair tax or flat tax that have as one of their objectives the elimination of the IRS as we know it. The IRS employs 91,000 employees with an annual budget of $11.4 billion. The Cato institute estimates that business and individuals spend 6.4 billion hours per year in tax compliance, which the Tax Foundation estimated to be worth $265.1 billion in 2005. Between these two expenses, McCain should be able to cut $65 billion and “re-purpose” (a government euphemism for spend) the rest. Tacitly assumed in Obama’s argument is the assumption that every penny needs to be replaced, as though it is well spent. In 1993, the General Accounting Office (GAO) audited the IRS for the first time in its history and found widespread evidence of financial malfeasance and gross negligence, including the fact that the agency was unable to account for 64% of its congressional appropriation. Corporate Taxation. Obama is in favor of raising the current 15% tax rate on long-term capital gains and dividends to 28%. Raising the tax rate would lower after-tax returns on equities, just as baby-boomers enter retirement, further impacting their retirement incomes, as well as throwing a wet blanket on the economy, as it is trying to avoid recession. Obama also advocates treating dividends as ordinary income. McCain has pledged to keep current rates on dividends and capital gains at their present level. “When rates are low, companies pay out more retained earnings and dividends, and dividends spur economic growth as investors plow the money back into other companies,” says Raj Chetty, professor of economics at UC-Berkley, who has studied how corporations respond to a favorable dividend rate.

Corporate Taxation. Obama is in favor of raising the current 15% tax rate on long-term capital gains and dividends to 28%. Raising the tax rate would lower after-tax returns on equities, just as baby-boomers enter retirement, further impacting their retirement incomes, as well as throwing a wet blanket on the economy, as it is trying to avoid recession. Obama also advocates treating dividends as ordinary income. McCain has pledged to keep current rates on dividends and capital gains at their present level. “When rates are low, companies pay out more retained earnings and dividends, and dividends spur economic growth as investors plow the money back into other companies,” says Raj Chetty, professor of economics at UC-Berkley, who has studied how corporations respond to a favorable dividend rate. Social Security, Medicare, Medicaid. Neither candidate has proposed definitive approaches to solving the Medicare and Social Security issues facing the country. If healthcare costs continue to outpace the growth in GDP, do not expect the estate tax, which is scheduled to be reinstituted and jump from 0% in 2010 to 55% in 2011 for estates over $1M, to close this gap. McCain has suggested he would support higher exemption levels and lower tax rates: a 15% estate tax with a $10 million exemption for couples. Obama has no plan other than to let the tax expire. According to Sandra Day O’Connor (former Supreme Court Justice) and James R. Jones (former Ambassador to Mexico), in their OpEd piece “What we owe our young,” Virginian Pilot, June 17, 2008, “Even if every dollar of wealth of every millionaire in the United States were magically diverted to pay these costs [Social Security, Medicare, and Medicaid bill that are coming due over the next several decades], 80 percent of the unfunded liabilities forecast for these three programs would remain on the books.” [Emphasis mine]

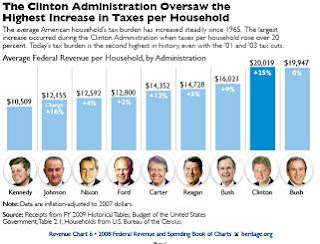

Social Security, Medicare, Medicaid. Neither candidate has proposed definitive approaches to solving the Medicare and Social Security issues facing the country. If healthcare costs continue to outpace the growth in GDP, do not expect the estate tax, which is scheduled to be reinstituted and jump from 0% in 2010 to 55% in 2011 for estates over $1M, to close this gap. McCain has suggested he would support higher exemption levels and lower tax rates: a 15% estate tax with a $10 million exemption for couples. Obama has no plan other than to let the tax expire. According to Sandra Day O’Connor (former Supreme Court Justice) and James R. Jones (former Ambassador to Mexico), in their OpEd piece “What we owe our young,” Virginian Pilot, June 17, 2008, “Even if every dollar of wealth of every millionaire in the United States were magically diverted to pay these costs [Social Security, Medicare, and Medicaid bill that are coming due over the next several decades], 80 percent of the unfunded liabilities forecast for these three programs would remain on the books.” [Emphasis mine]America’s problems are grave. However, proposing new spending and raising tax rates to cover them is only a band-aid fix: they must be seriously addressed. Taking money out of the hands of “hard working” Americans and putting them in the hands of politicians has resulted in a 334% increase in Federal spending since 1965 (from $628 billion to $2.7 trillion in 2007 inflation adjusted dollars), while the median income of the average American has risen 35% ($28,346 to $38,386). Over this period, mandatory spending on entitlement programs has grown from 26.9% of the budget to 52.9% of the budget. When interest is considered (8.3%), only 38.8% of the budget is discretionary (within the control of the President). A better solution is to take the decision making out of the hands of a do-nothing, socially progressive government and let the average “hard working” American decide for himself or herself how to spend his or her income. Clearly, Obama’s proposals would make this much, much more difficult.

For additional information on this subject, see the Heritage Foundation, 2008 Federal Revenues and Spending Book of Charts, at:

http://www.heritage.org/research/features/budgetchartbook/index.html

1 comment:

If you look at each time the taxes were raised it was after the republican party had it's reigns at office. IMHO every time the demecrats get this country in the black (ink that it) the republicans turns that back into the red, by trillions of dollars. How hard would it be if you had to survive on a budget that stayed in the red? The rich does not know. It would take a rich person to concoct a spin on taxing the rich.

Furthermore these last 8 years have been hell on my family, I can't afford to go anywhere (gas Prices), I can't afford to buy any luxuries...you know Milk, eggs, meat. The rich know nothing about how hard it is to be middle class.

Post a Comment